Question: You are considering two short term mutually exclusive projects, X and Y. Project X has an initial cost of $50 million and equal cash flows

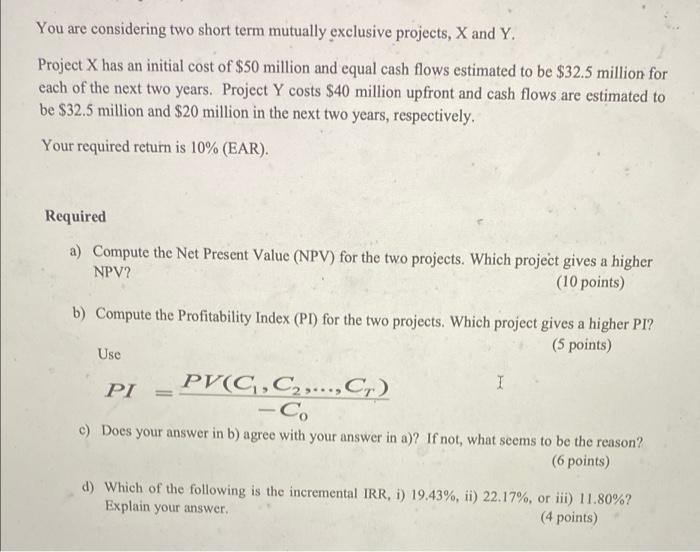

You are considering two short term mutually exclusive projects, X and Y. Project X has an initial cost of $50 million and equal cash flows estimated to be $32.5 million for each of the next two years. Project Y costs $40 million upfront and cash flows are estimated to be $32.5 million and $20 million in the next two years, respectively. Your required return is 10% (EAR). Required a) Compute the Net Present Value (NPV) for the two projects. Which project gives a higher NPV? (10 points) b) Compute the Profitability Index (PI) for the two projects. Which project gives a higher PI? (5 points) Use PI PVC,C2,...,C,) -C. c) Does your answer in b) agree with your answer in a)? If not, what seems to be the reason? (6 points) d) Which of the following is the incremental IRR, 1) 19.43%, ii) 22.17%, or iii) 11.80%? Explain your answer. (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts