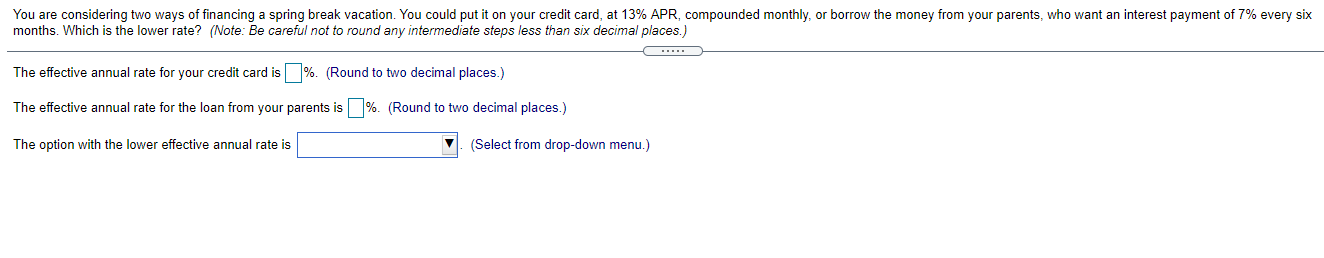

Question: You are considering two ways of financing a spring break vacation. You could put it on your credit card, at 13% APR, compounded monthly, or

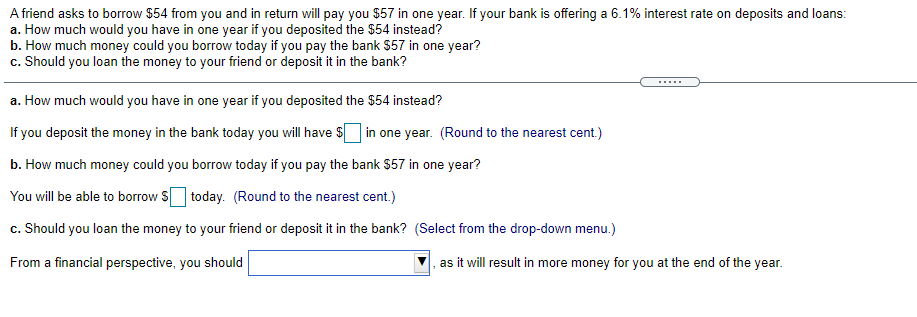

You are considering two ways of financing a spring break vacation. You could put it on your credit card, at 13% APR, compounded monthly, or borrow the money from your parents who want an interest payment of 7% every six months. Which is the lower rate? (Note: Be careful not to round any intermediate steps less than six decimal places.) The effective annual rate for your credit card is %. (Round to two decimal places.) The effective annual rate for the loan from your parents is % (Round to two decimal places.) The option with the lower effective annual rate is (Select from drop-down menu.) A friend asks to borrow $54 from you and in return will pay you $57 in one year. If your bank is offering a 6.1% interest rate on deposits and loans: a. How much would you have in one year if you deposited the $54 instead? b. How much money could you borrow today if you pay the bank $57 in one year? c. Should you loan the money to your friend or deposit it in the bank? a. How much would you have in one year if you deposited the $54 instead? If you deposit the money in the bank today you will have $ in one year. (Round to the nearest cent.) b. How much money could you borrow today if you pay the bank 557 in one year? You will be able to borrow $ today. (Round to the nearest cent.) c. Should you loan the money to your friend or deposit it in the bank? (Select from the drop-down menu.) From a financial perspective, you should as it will result in more money for you at the end of the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts