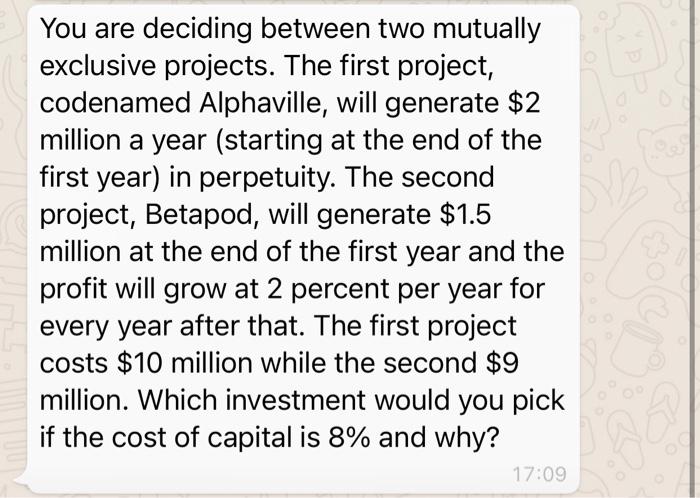

Question: You are deciding between two mutually exclusive projects. The first project, codenamed Alphaville, will generate $2 million a year (starting at the end of the

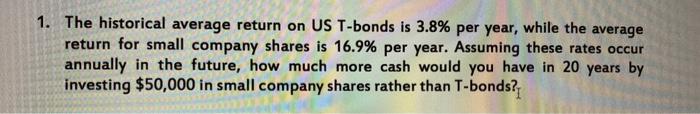

You are deciding between two mutually exclusive projects. The first project, codenamed Alphaville, will generate $2 million a year (starting at the end of the first year) in perpetuity. The second project, Betapod, will generate $1.5 million at the end of the first year and the profit will grow at 2 percent per year for every year after that. The first project costs $10 million while the second $9 million. Which investment would you pick if the cost of capital is 8% and why? 17:09 1. The historical average return on US T-bonds is 3.8% per year, while the average return for small company shares is 16.9% per year. Assuming these rates occur annually in the future, how much more cash would you have in 20 years by investing $50,000 in small company shares rather than T-bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts