Question: You are deciding to choose between three mutually exclusive projects. a. option1: project X will cost $5000 to install and $4000 a year to

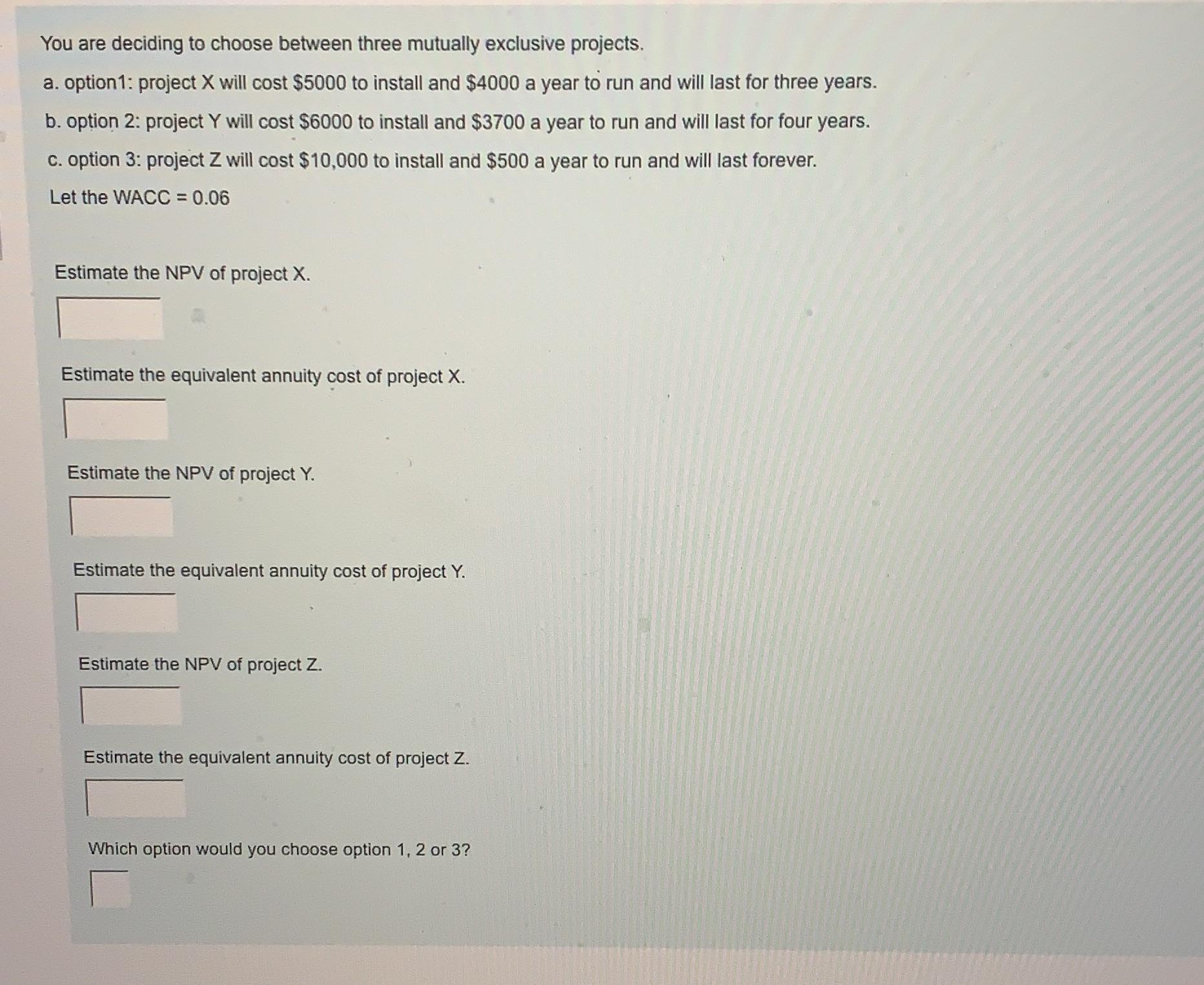

You are deciding to choose between three mutually exclusive projects. a. option1: project X will cost $5000 to install and $4000 a year to run and will last for three years. b. option 2: project Y will cost $6000 to install and $3700 a year to run and will last for four years. c. option 3: project Z will cost $10,000 to install and $500 a year to run and will last forever. Let the WACC = 0.06 Estimate the NPV of project X. Estimate the equivalent annuity cost of project X. Estimate the NPV of project Y. Estimate the equivalent annuity cost of project Y. Estimate the NPV of project Z. Estimate the equivalent annuity cost of project Z. Which option would you choose option 1, 2 or 3?

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Net Present Value NPV of ProjectX Year Annual cash flows Present Value Factor PVF at 700 Present Val... View full answer

Get step-by-step solutions from verified subject matter experts