Question: You are estimating the probability of default for a given firm using the options model of default risk where this probability is given by: Prob

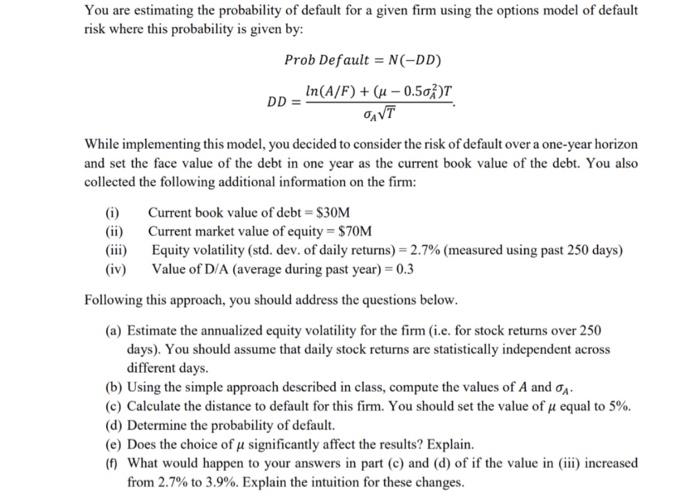

You are estimating the probability of default for a given firm using the options model of default risk where this probability is given by: Prob Default = N(-DD) In(A/F) + (u - 0.502)T DD = OAVT While implementing this model, you decided to consider the risk of default over a one-year horizon and set the face value of the debt in one year as the current book value of the debt. You also collected the following additional information on the firm: (i) Current book value of debt = $30M (ii) Current market value of equity = $70M (iii) Equity volatility (std. dev. of daily returns) = 2.7% (measured using past 250 days) (iv) Value of D/A (average during past year) = 0.3 Following this approach, you should address the questions below. (a) Estimate the annualized equity volatility for the firm (i.e. for stock returns over 250 days). You should assume that daily stock returns are statistically independent across different days. (b) Using the simple approach described in class, compute the values of A and on (c) Calculate the distance to default for this firm. You should set the value of je equal to 5%. (d) Determine the probability of default. (e) Does the choice of u significantly affect the results? Explain. In What would happen to your answers in part (c) and (d) of if the value in (iii) increased from 2.7% to 3.9%. Explain the intuition for these changes. You are estimating the probability of default for a given firm using the options model of default risk where this probability is given by: Prob Default = N(-DD) In(A/F) + (u - 0.502)T DD = OAVT While implementing this model, you decided to consider the risk of default over a one-year horizon and set the face value of the debt in one year as the current book value of the debt. You also collected the following additional information on the firm: (i) Current book value of debt = $30M (ii) Current market value of equity = $70M (iii) Equity volatility (std. dev. of daily returns) = 2.7% (measured using past 250 days) (iv) Value of D/A (average during past year) = 0.3 Following this approach, you should address the questions below. (a) Estimate the annualized equity volatility for the firm (i.e. for stock returns over 250 days). You should assume that daily stock returns are statistically independent across different days. (b) Using the simple approach described in class, compute the values of A and on (c) Calculate the distance to default for this firm. You should set the value of je equal to 5%. (d) Determine the probability of default. (e) Does the choice of u significantly affect the results? Explain. In What would happen to your answers in part (c) and (d) of if the value in (iii) increased from 2.7% to 3.9%. Explain the intuition for these changes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts