Question: You are evaluating 2 condominium rental properties. Both sell for P6.0M. One is located in Makati and one located in BGC. You determine the

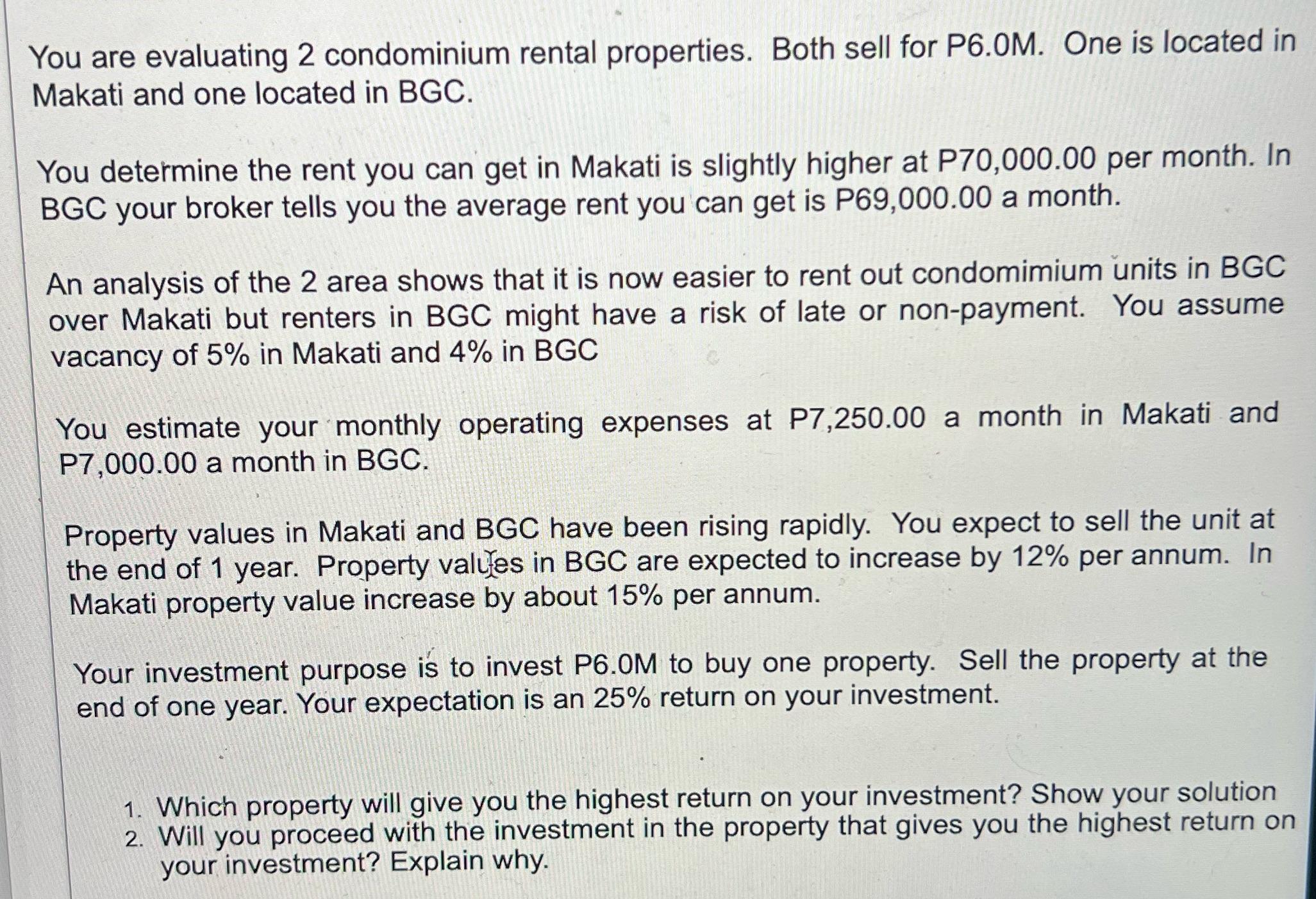

You are evaluating 2 condominium rental properties. Both sell for P6.0M. One is located in Makati and one located in BGC. You determine the rent you can get in Makati is slightly higher at P70,000.00 per month. In BGC your broker tells you the average rent you can get is P69,000.00 a month. An analysis of the 2 area shows that it is now easier to rent out condomimium units in BGC over Makati but renters in BGC might have a risk of late or non-payment. You assume vacancy of 5% in Makati and 4% in BGC You estimate your monthly operating expenses at P7,250.00 a month in Makati and P7,000.00 a month in BGC. Property values in Makati and BGC have been rising rapidly. You expect to sell the unit at the end of 1 year. Property values in BGC are expected to increase by 12% per annum. In Makati property value increase by about 15% per annum. Your investment purpose is to invest P6.0M to buy one property. Sell the property at the end of one year. Your expectation is an 25% return on your investment. 1. Which property will give you the highest return on your investment? Show your solution 2. Will you proceed with the investment in the property that gives you the highest return on your investment? Explain why.

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

To determine the property that will give the highest return on investment we need to calculate the n... View full answer

Get step-by-step solutions from verified subject matter experts