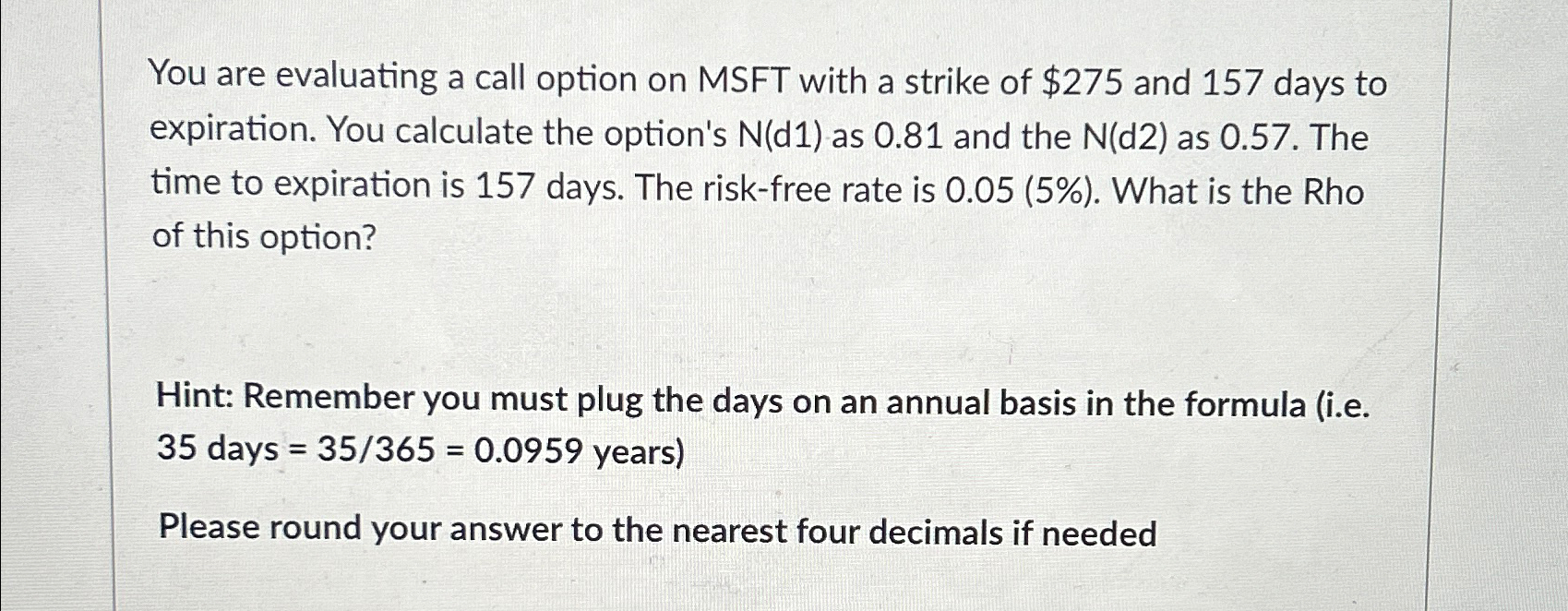

Question: You are evaluating a call option on MSFT with a strike of $ 2 7 5 and 1 5 7 days to expiration. You calculate

You are evaluating a call option on MSFT with a strike of $ and days to expiration. You calculate the option's as and the as The time to expiration is days. The riskfree rate is What is the Rho of this option?

Hint: Remember you must plug the days on an annual basis in the formula ie days years

Please round your answer to the nearest four decimals if needed

The answer is Please show steps how to calculate this number!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock