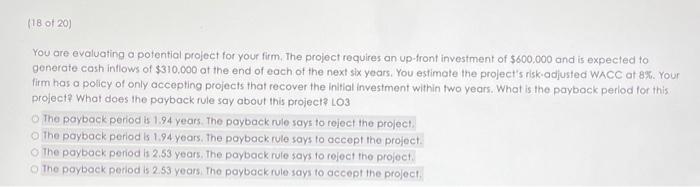

Question: You are evaluating a potential project for your firm. The project requires an up-front investment of $600,000 and is expected to generate cash intlows of

You are evaluating a potential project for your firm. The project requires an up-front investment of $600,000 and is expected to generate cash intlows of $310,000 ot the end of each of the next six years. You estimate the project's risk-adjusted WACC at 89 . Your firm has a policy of only accepting projects that recover the inlial investment within two years. What is the paybock perlod tor this project? What does the payback rule say about this project? LO3 The payback period is 1.94 years. The payback rule says to reject the project. The paybock period is 1.94 years. The payback rule says to accept the project. The paybock period is 2.53 years. The payback rule says to reject the projoct. The paybock period is 2.53 years the paybackrule says to accept the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts