Question: You are evaluating a project. It requires equipment with an installed cost of $3,000,000. Your boss is interested in your decision on which depreciation method

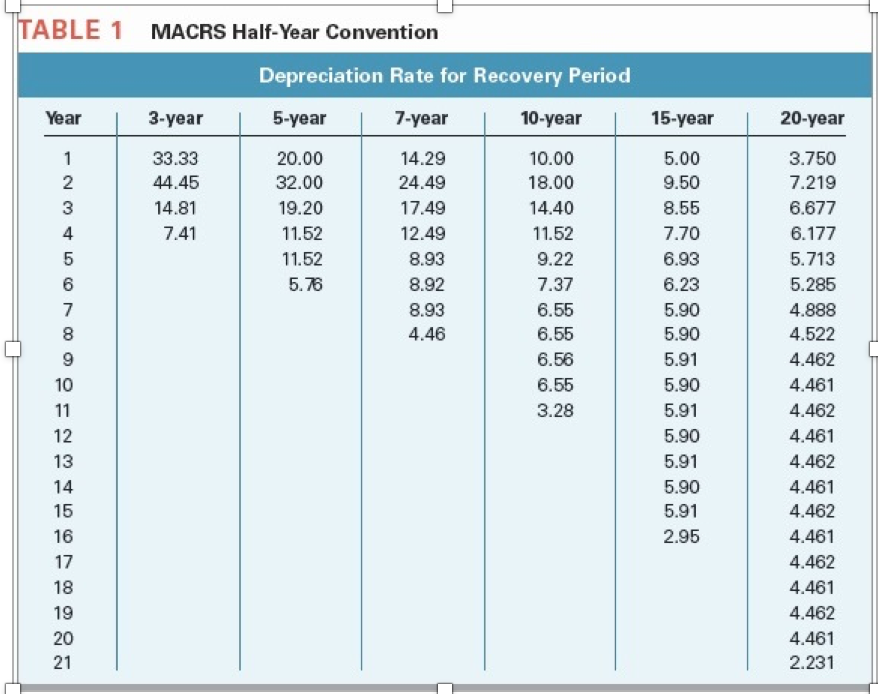

- You are evaluating a project. It requires equipment with an installed cost of $3,000,000. Your boss is interested in your decision on which depreciation method to use straight line or MACRS. The equipment has a useful life of 4 years, and so would be depreciated on a straight line basis to a zero salvage value. Under the MACRS rules, the equipment qualifies as a 3 year asset. The opportunity cost for the company is 12%, and the company is in the 40% tax bracket. Make your case for which would provide the highest value to the company.

TABLE 1 MACRS Half-Year Convention Depreciation Rate for Recovery Period Year 3-year 5-year 7-year 10-year 15-year 20-year 33.33 20.00 14.29 10.00 5.00 3.750 1 2 44.45 32.00 24.49 18.00 9.50 7.219 3 14.81 19.20 17.49 6.677 14.40 8.55 4 7.41 11.52 12.49 11.52 7.70 6.177 8.93 5 11.52 9.22 6.93 5.713 6 5.76 8.92 7.37 6.23 5.285 7 6.55 8.93 5.90 4.888 8 6.55 5.90 4.522 4.46 9 6.56 5.91 4.462 4.461 10 6.55 5.90 11 3.28 5.91 4.462 12 5.90 4.461 13 5.91 4.462 4.461 14 5.90 4.462 15 5.91 16 2.95 4.461 4.462 17 4.461 18 19 4.462 20 4.461 21 2.231

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock