Question: You are evaluating a project that will cost $487,000, but is expected to produce cash ows of $125,000 per year for 10 years, with the

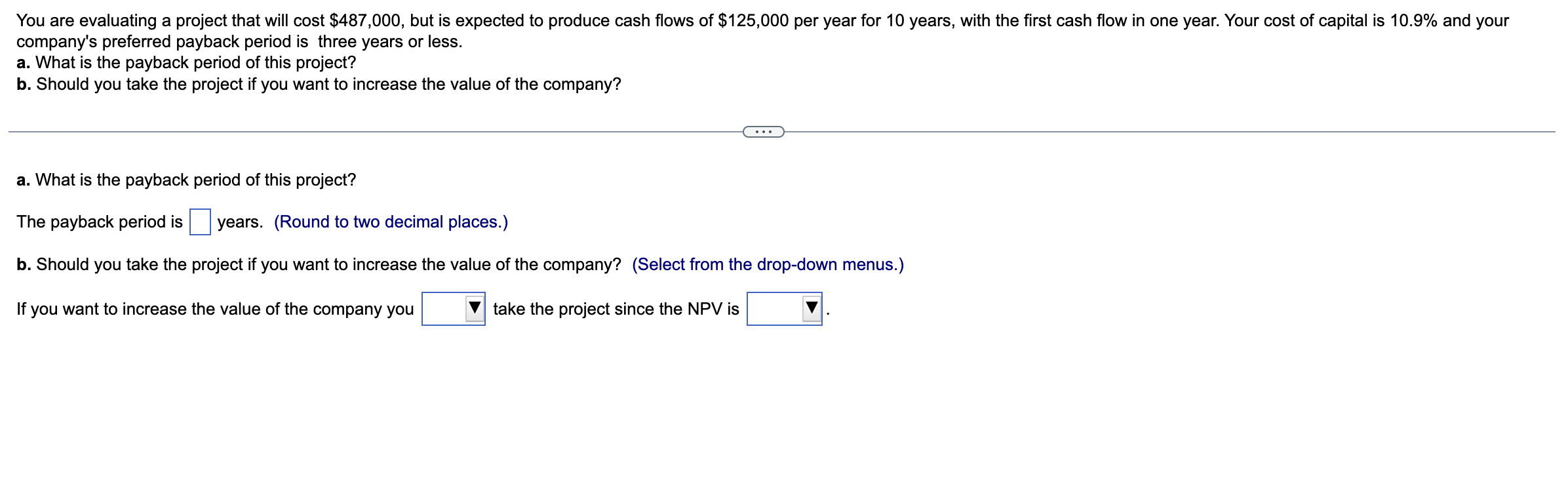

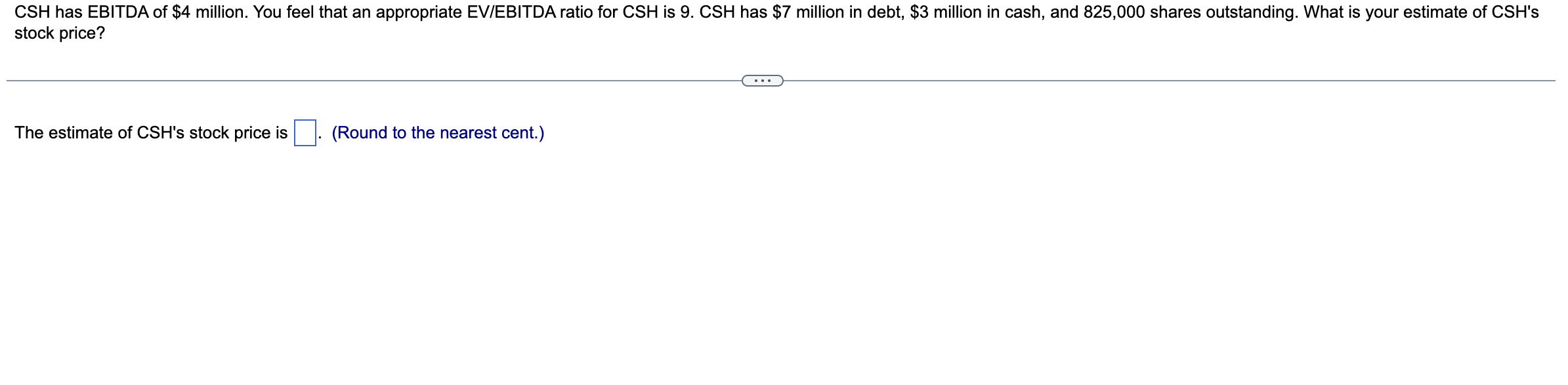

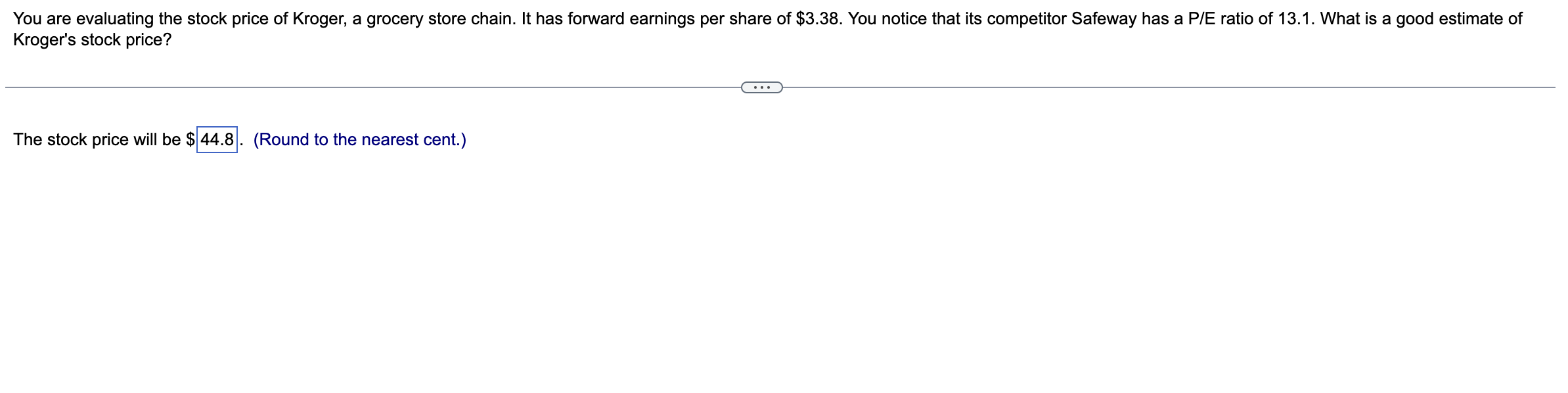

You are evaluating a project that will cost $487,000, but is expected to produce cash ows of $125,000 per year for 10 years, with the first cash ow in one year. Your cost of capital is 10.9% and your company's preferred payback period is three years or less. a. What is the payback period of this project? b. Should you take the project if you want to increase the value of the company? a. What is the payback period of this project? The payback period is years. (Round to two decimal places.) b. Should you take the project if you want to increase the value of the company? (Select from the drop-down menus.) If you want to increase the value of the company you V take the project since the NPV is V . CSH has EBITDA of $4 million. You feel that an appropriate EV/EBITDA ratio for CSH is 9. CSH has $7 million in debt, $3 million in cash, and 825,000 shares outstanding. What is your estimate of CSH's stock price? The estimate of CSH's stock price is . (Round to the nearest cent.)You are evaluating the stock price of Kroger, a grocery store chain. It has fonivard earnings per share of $3.38. You notice that its competitor Safeway has a P/E ratio of 13.1. What is a good estimate of Kroger's stock price? The stock price will be 5 44.8 . (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts