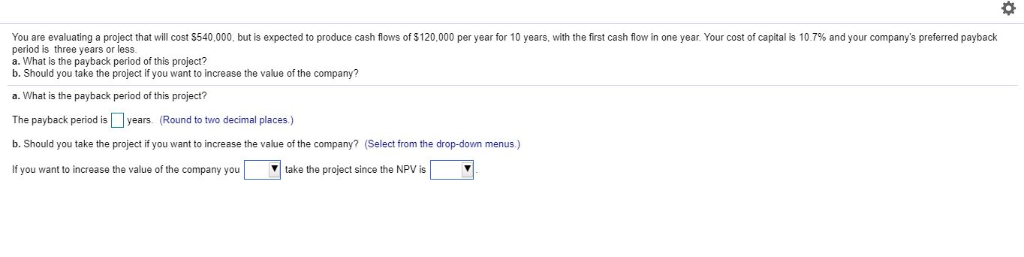

Question: You are evaluating a project that will cost S54 , but is expected to produce cash flows of $120 000 per year for 10 year

You are evaluating a project that will cost S54 , but is expected to produce cash flows of $120 000 per year for 10 year period is three years or less. a. What is the payback period of this project? b. Should you take the project if you want to increase the value of the company? with the first cash flow one year Your cost of capital 1 7% and your companys rete e c a. What is the payback period of this project? The payback period is years (Round to two decimal places) b. Should you take the project if you want to increase the value of the company? (Select from the drop-dowm menus.) you want to increase the value of the company you take the project since the NPV is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts