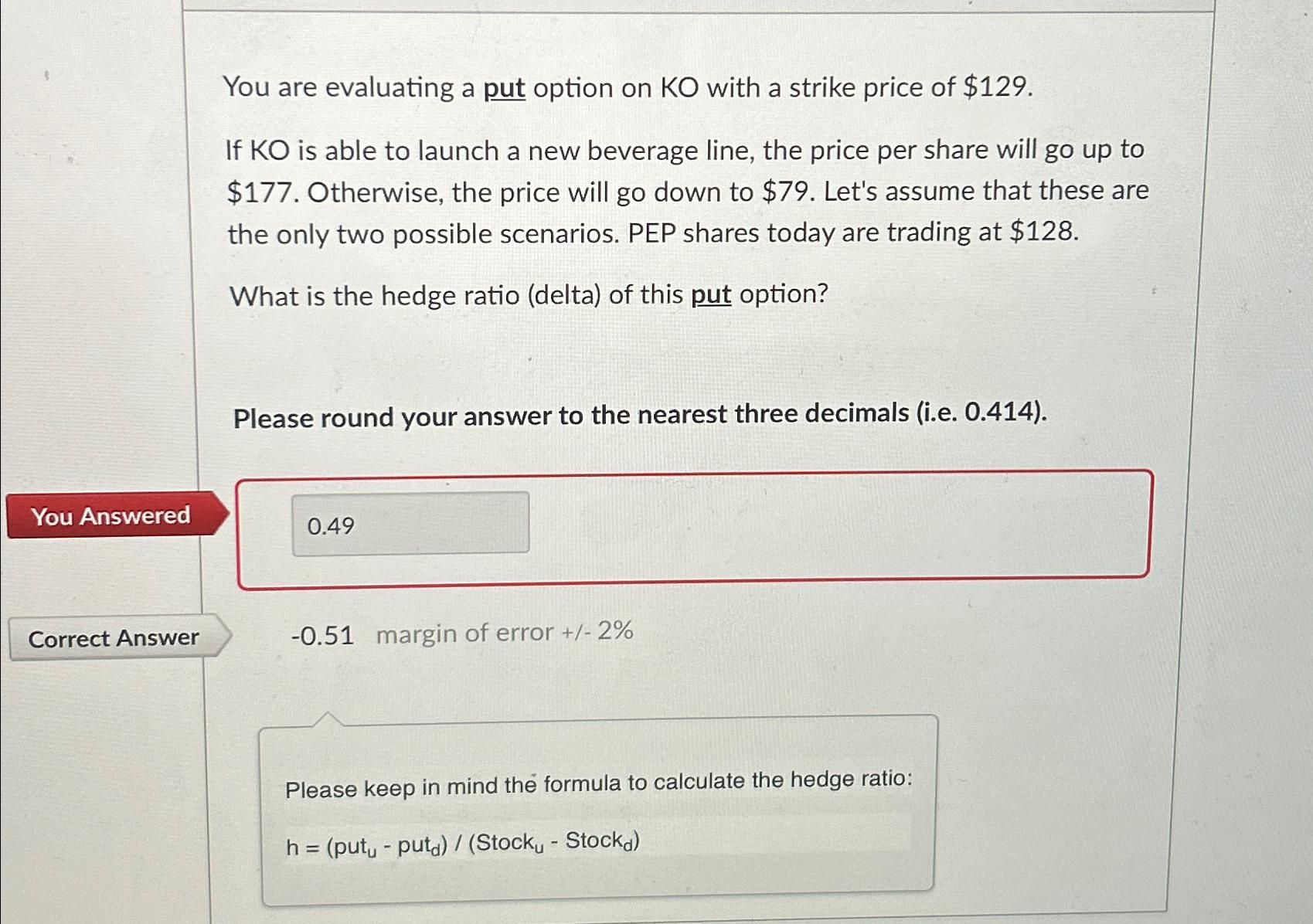

Question: You are evaluating a put option on K O with a strike price of $ 1 2 9 . If K O is able to

You are evaluating a put option on with a strike price of $

If is able to launch a new beverage line, the price per share will go up to $ Otherwise, the price will go down to $ Let's assume that these are the only two possible scenarios. PEP shares today are trading at $

What is the hedge ratio delta of this put option?

Please round your answer to the nearest three decimals ie

You Answered

Correct Answer

margin of error

Please keep in mind the formula to calculate the hedge ratio:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock