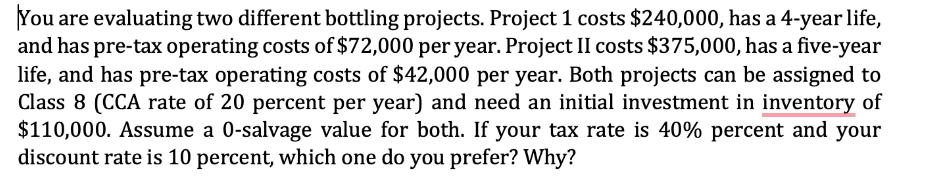

Question: You are evaluating two different bottling projects. Project 1 costs $240,000, has a 4-year life, and has pre-tax operating costs of $72,000 per year.

You are evaluating two different bottling projects. Project 1 costs $240,000, has a 4-year life, and has pre-tax operating costs of $72,000 per year. Project II costs $375,000, has a five-year life, and has pre-tax operating costs of $42,000 per year. Both projects can be assigned to Class 8 (CCA rate of 20 percent per year) and need an initial investment in inventory of $110,000. Assume a 0-salvage value for both. If your tax rate is 40% percent and your discount rate is 10 percent, which one do you prefer? Why?

Step by Step Solution

There are 3 Steps involved in it

Project 1 is the preferred project with a higher present value based on the given parameters Here... View full answer

Get step-by-step solutions from verified subject matter experts