Question: You are evaluating two different database management systems for IIT's admissions department. The Banner I costs $800,000, has a six-year useful life, and has operating

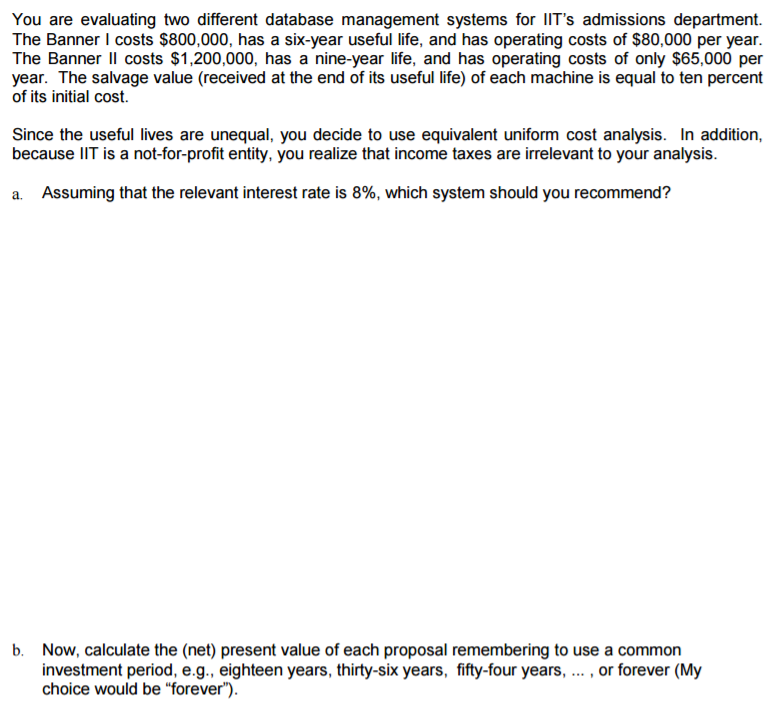

You are evaluating two different database management systems for IIT's admissions department. The Banner I costs $800,000, has a six-year useful life, and has operating costs of $80,000 per year. The Banner II costs $1, 200,000, has a nine-year life, and has operating costs of only $65,000 per year. The salvage value (received at the end of its useful life) of each machine is equal to ten percent of its initial cost. Since the useful lives are unequal, you decide to use equivalent uniform cost analysis. In addition, because IIT is a not-for-profit entity, you realize that income taxes are irrelevant to your analysis. Assuming that the relevant interest rate is 8%, which system should you recommend? Now, calculate the (net) present value of each proposal remembering to use a common investment period, e g., eighteen years, thirty-six years, fifty-four years.....or forever (My choice would be "forever")

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts