Question: You are faced with two mutually exclusive projects. If the required rate of return is 15.47%, the NPV of Project A equals that of Project

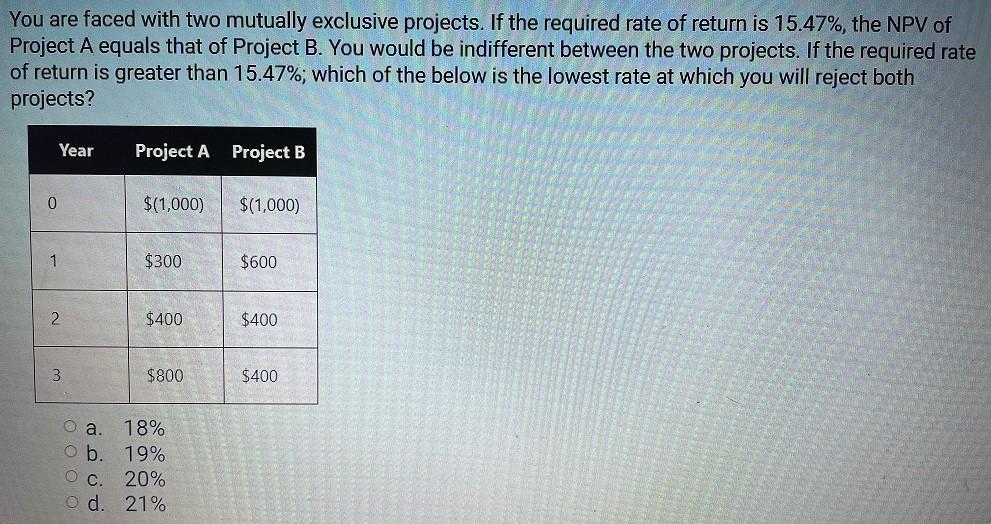

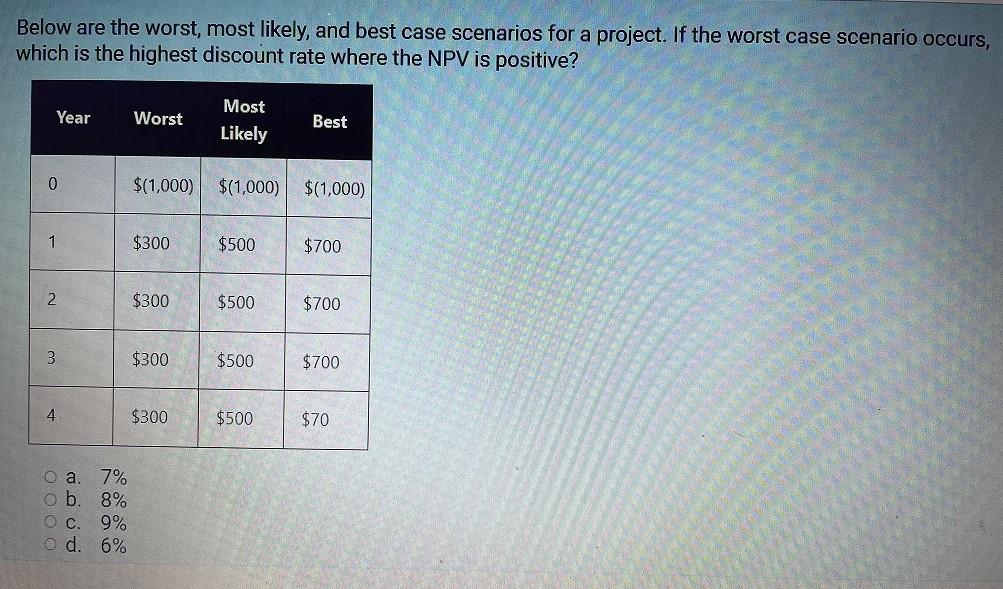

You are faced with two mutually exclusive projects. If the required rate of return is 15.47%, the NPV of Project A equals that of Project B. You would be indifferent between the two projects. If the required rate of return is greater than 15.47%; which of the below is the lowest rate at which you will reject both projects? Year Project A Project B 0 $(1,000) $(1,000) 1 $300 $600 2 $400 $400 3 $800 $400 O a. 18% ob. 19% C. 20% O d. 21% Below are the worst, most likely, and best case scenarios for a project. If the worst case scenario occurs, which is the highest discount rate where the NPV is positive? Year Worst Most Likely Best 0 $(1,000) $(1,000) $(1,000) 1 $300 $500 $700 2 $300 $500 $700 3 $300 $500 $700 4 $300 $500 $70 O a. 7% ob. 8% O c. 9% o d. 6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts