Question: You are facing two options to get value from the property: ( 1 ) Continue to own the building and reap the benefits of those

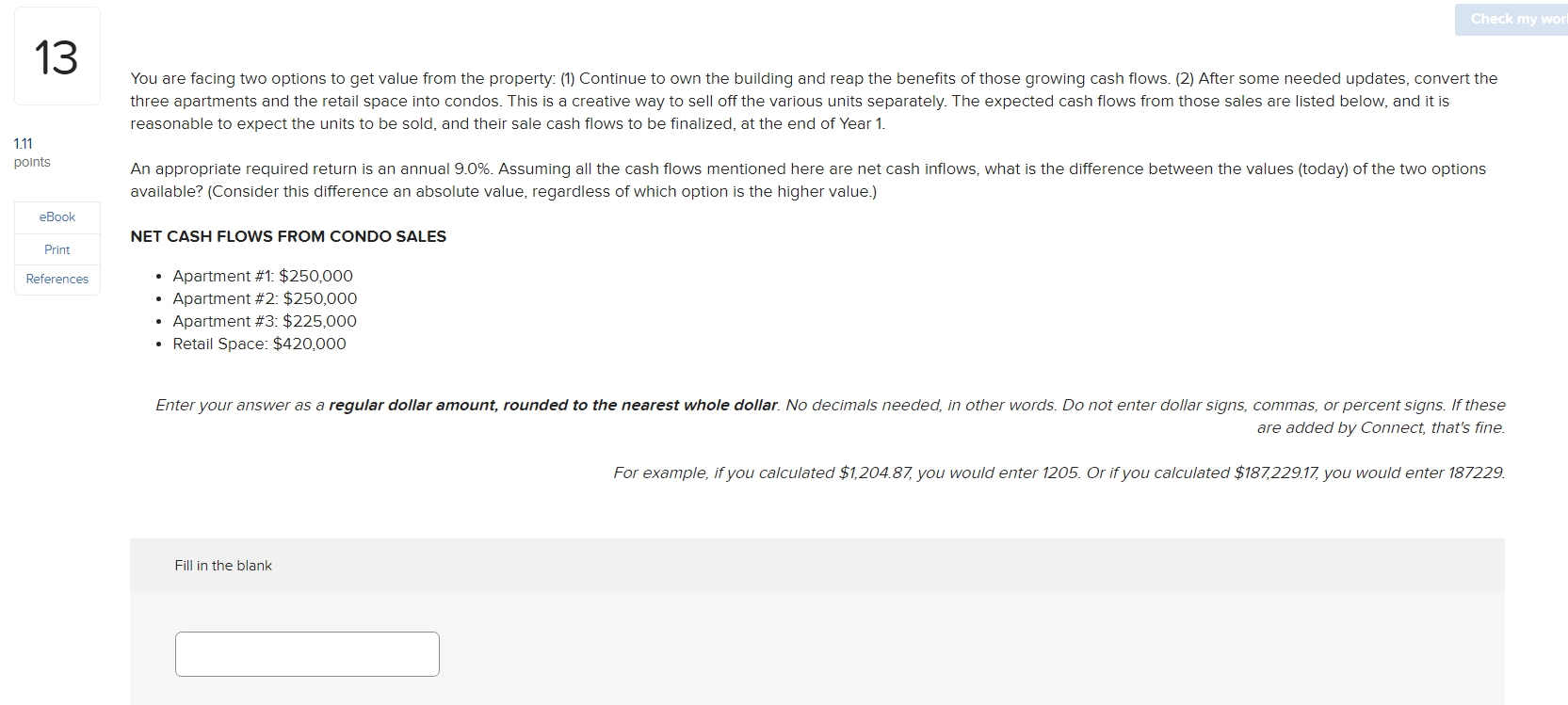

You are facing two options to get value from the property: Continue to own the building and reap the benefits of those growing cash flows. After some needed updates, convert the

three apartments and the retail space into condos. This is a creative way to sell off the various units separately. The expected cash flows from those sales are listed below, and it is

reasonable to expect the units to be sold, and their sale cash flows to be finalized, at the end of Year

An appropriate required return is an annual Assuming all the cash flows mentioned here are net cash inflows, what is the difference between the values today of the two options

available? Consider this difference an absolute value, regardless of which option is the higher value.

NET CASH FLOWS FROM CONDO SALES

Apartment#: $

Apartment #: $

Apartment #: $

Retail Space: $

Enter your answer as a regular dollar amount, rounded to the nearest whole dollar. No decimals needed, in other words. Do not enter dollar signs, commas, or percent signs. If these

are added by Connect, that's fine.

For example, if you calculated $ you would enter Or if you calculated $ you would enter

Fill in the blank

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock