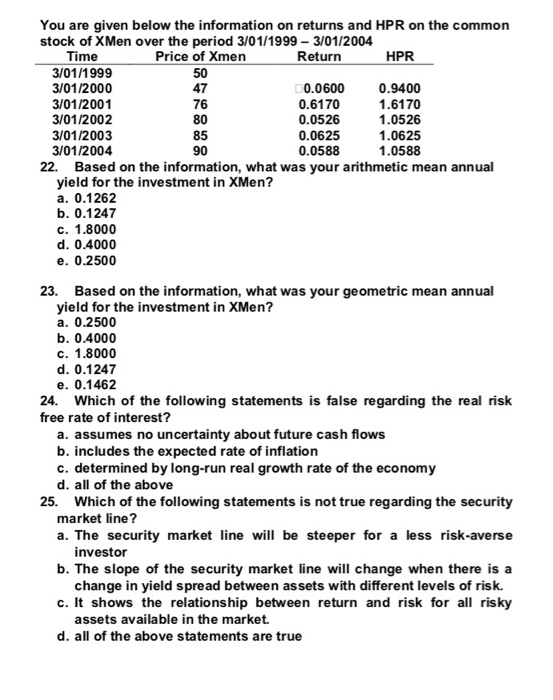

Question: You are given below the information on returns and HPR on the common stock of XMen over the period 3/01/1999- 3/01/2004 Return Time 3/01/1999 3/01/2000

You are given below the information on returns and HPR on the common stock of XMen over the period 3/01/1999- 3/01/2004 Return Time 3/01/1999 3/01/2000 3/01/2001 3/01/2002 3/01/2003 3/01/2004 Price of Xmen 50 47 76 80 85 90 HPR 0.0600 0.6170 0.0526 0.0625 0.0588 0.9400 1.6170 1.0526 1.0625 1.0588 22. Based on the information, what was your arithmetic mean annual yield for the investment in XMen? a. 0.1262 b. 0.1247 c. 1.8000 d. 0.4000 e. 0.2500 23. Based on the information, what was your geometric mean annual yield for the investment in XMen? a. 0.2500 b. 0.4000 c. 1.8000 d. 0.1247 e. 0.1462 24. Which of the following statements is false regarding the real risk free rate of interest? a. assumes no uncertainty about future cash flows b. includes the expected rate of inflation c. determined by long-run real growth rate of the economy d. all of the above 25. Which of the following statements is not true regarding the security market line? a. The security market line will be steeper for a less risk-averse investor b. The slope of the security market line will change when there is a c. It shows the relationship between return and risk for all risky d. all of the above statements are true change in yield spread between assets with different levels of risk. assets available in the market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts