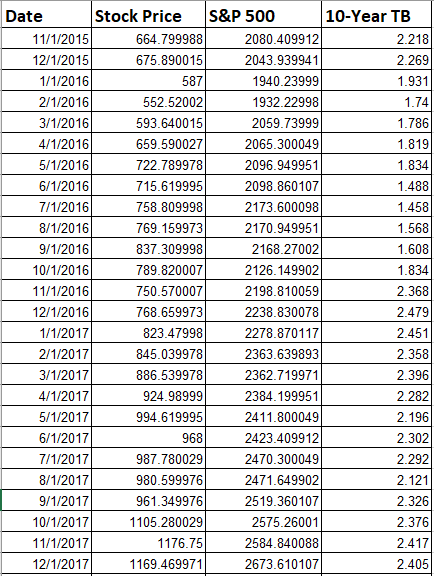

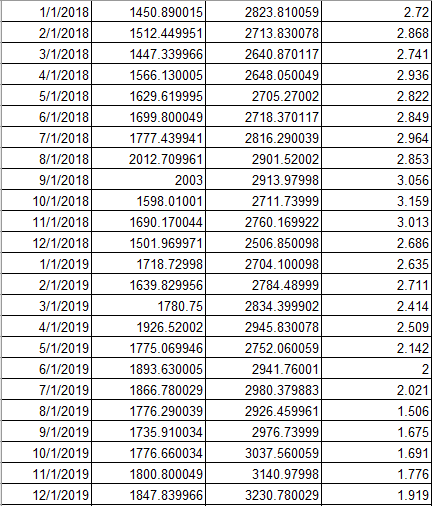

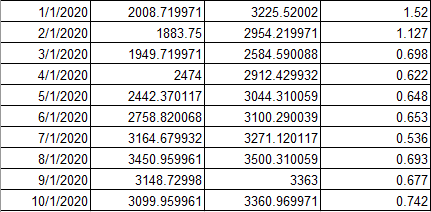

Question: You are given monthly price data on Amazon.Com, Inc. (AMZN), S&P 500 index, and monthly yield on 10-year U.S. Government bonds for the period 2015-2020,

You are given monthly price data on Amazon.Com, Inc. (AMZN), S&P 500 index, and monthly yield on 10-year U.S.

Government bonds for the period 2015-2020, see attached.

Using regression analysis on the above data, you are asked to answer the questions below:

A. What is the estimate of Amazons levered beta? Show your regression results (dependent and independent variables, coefficient estimates, t-values, R2, etc.).

B. What is the estimate of Amazons unlevered beta?

If possible to pride detailed calculations for unlevered beta in part b?

Date Stock Price S&P 500 11/1/2015 664.799988 2080.409912 12/1/2015 675.890015 2043.939941 1/1/2016 587 1940.23999 2/1/2016 552.52002 1932.22998 3/1/2016 593.640015 2059.73999 4/1/2016 659.590027 2065.300049 5/1/2016 722.789978 2096.949951 6/1/2016 715.619995 2098.860107 7/1/2016 758.809998 2173.600098 8/1/2016 769.159973 2170.949951 9/1/2016 837.309998 2168.27002 10/1/2016 789.820007 2126. 149902 11/1/2016 750.570007 2198.810059 12/1/2016 768.659973 2238.830078 1/1/2017 823.47998 2278.870117 2/1/2017 845.039978 2363.639893 3/1/2017 886.539978 2362.719971 4/1/2017 924.98999 2384.199951 5/1/2017 994.619995 2411.800049 6/1/2017 968 2423.409912 7/1/2017 987.780029 2470.300049 8/1/2017 980.599976 2471.649902 9/1/2017 961.349976 2519.360107 10/1/2017 1105.280029 2575.26001 11/1/2017 1176.75 2584.840088 12/1/2017 1169.469971 2673.610107 10-Year TB 2.218 2.269 1.931 1.74 1.786 1.819 1.834 1.488 1.458 1.568 1.608 1.834 2.368 2.479 2.451 2.358 2.396 2.282 2.196 2.302 2.292 2.121 2.326 2.376 2.417 2.405 1/1/2018 2/1/2018 3/1/2018 4/1/2018 5/1/2018 6/1/2018 7/1/2018 8/1/2018 9/1/2018 10/1/2018 11/1/2018 12/1/2018 1/1/2019 2/1/2019 3/1/2019 4/1/2019 5/1/2019 6/1/2019 7/1/2019 8/1/2019 9/1/2019 10/1/2019 11/1/2019 12/1/2019 1450.890015 1512.449951 1447.339966 1566.130005 1629.619995 1699.800049 1777.439941 2012.709961 2003 1598.01001 1690.170044 1501.969971 1718.72998 1639.829956 1780.75 1926.52002 1775.069946 1893.630005 1866.780029 1776.290039 1735.910034 1776.660034 1800.800049 1847.839966 2823.810059 2713.830078 2640.870117 2648.050049 2705.27002 2718.370117 2816.290039 2901.52002 2913.97998 2711.73999 2760.169922 2506.850098 2704.100098 2784.48999 2834.399902 2945.830078 2752.060059 2941.76001 2980.379883 2926.459961 2976.73999 3037.560059 3140.97998 3230.780029 2.72 2.868 2.741 2.936 2.822 2.849 2.964 2.853 3.056 3.159 3.013 2.686 2.635 2.711 2.414 2.509 2.142 2 2.021 1.506 1.675 1.691 1.776 1.919 1/1/2020 2/1/2020 3/1/2020 4/1/2020 5/1/2020 6/1/2020 7/1/2020 8/1/2020 9/1/2020 10/1/2020 2008.719971 1883.75 1949.719971 2474 2442.370117 2758.820068 3164.679932 3450.959961 3148.72998 3099.959961 3225.52002 2954.219971 2584.590088 2912.429932 3044.310059 3100.290039 3271.120117 3500.310059 3363 3360.969971 1.52 1.127 0.698 0.622 0.648 0.653 0.536 0.693 0.677 0.742

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts