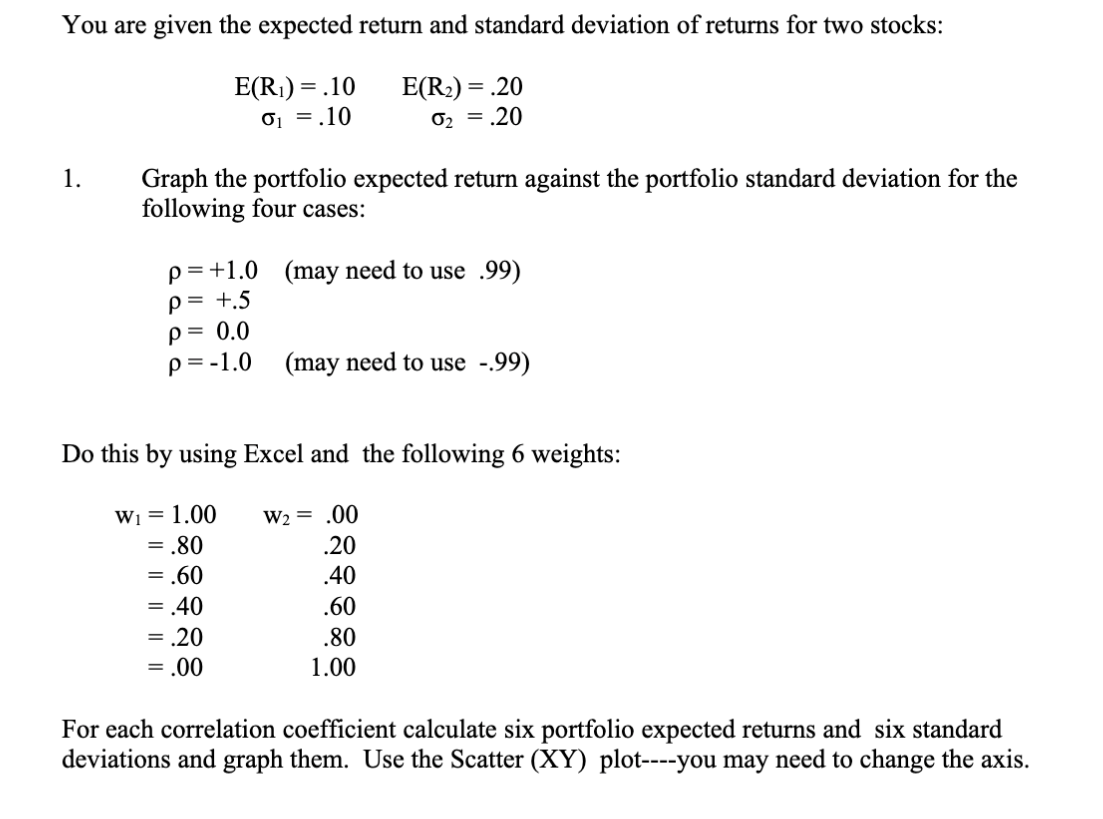

Question: You are given the expected return and standard deviation of returns for two stocks: E(Ri)= .10 0 = .10 E(R2) = .20 02 = 20

You are given the expected return and standard deviation of returns for two stocks: E(Ri)= .10 0 = .10 E(R2) = .20 02 = 20 1. Graph the portfolio expected return against the portfolio standard deviation for the following four cases: p= +1.0 (may need to use .99) p= +.5 p= 0.0 p=-1.0 (may need to use -99) Do this by using Excel and the following 6 weights: W1 = 1.00 = .80 = .60 = .40 = .20 = .00 W2 = .00 .20 .40 .60 .80 1.00 For each correlation coefficient calculate six portfolio expected returns and six standard deviations and graph them. Use the Scatter (XY) plot----you may need to change the axis

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock