Question: You are given the following data for expected annual return, E(R), and standard deviation of return, SD, for Stock A and Stock B. These values

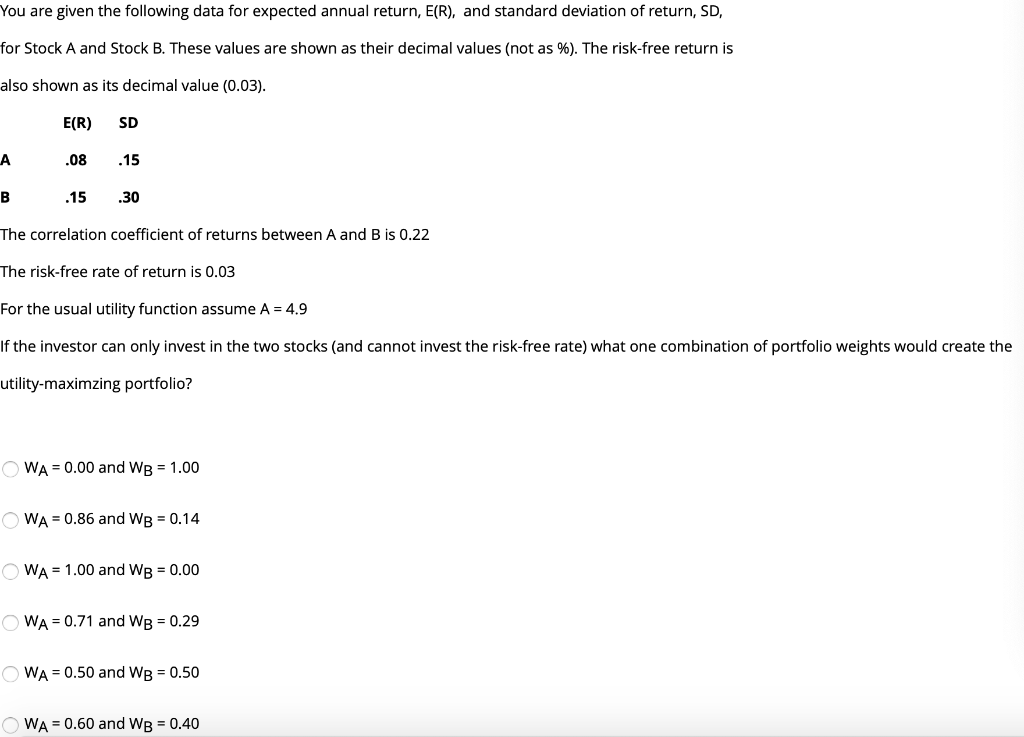

You are given the following data for expected annual return, E(R), and standard deviation of return, SD, for Stock A and Stock B. These values are shown as their decimal values (not as %). The risk-free return is also shown as its decimal value (0.03). E(R) SD A .08 .15 B 15 .30 The correlation coefficient of returns between A and B is 0.22 The risk-free rate of return is 0.03 For the usual utility function assume A = 4.9 If the investor can only invest in the two stocks (and cannot invest the risk-free rate) what one combination of portfolio weights would create the utility-maximzing portfolio? OWA = 0.00 and WB = 1.00 WA=0.86 and WB = 0.14 OWA = 1.00 and WB = 0.00 OWA = 0.71 and WB = 0.29 OWA = 0.50 and WB = 0.50 WA=0.60 and WB = 0.40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts