Question: You are given the following information on the expected returns, betas, and variance matrix of a group of stocks: Asset E(r) B Covariance Matrix Stock

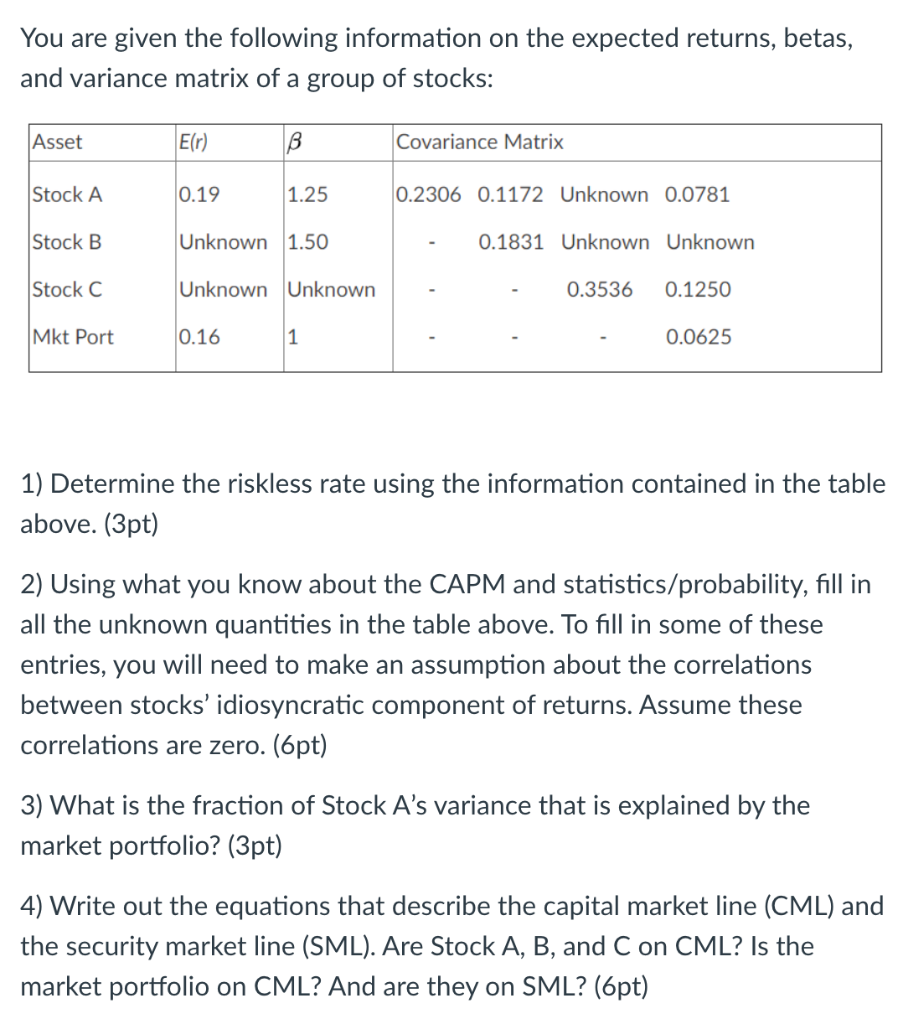

You are given the following information on the expected returns, betas, and variance matrix of a group of stocks: Asset E(r) B Covariance Matrix Stock A 0.19 1.25 0.2306 0.1172 Unknown 0.0781 Stock B Unknown 1.50 0.1831 Unknown Unknown Stock C Unknown Unknown 0.3536 0.1250 Mkt Port 0.16 1 0.0625 1) Determine the riskless rate using the information contained in the table above. (3pt) 2) Using what you know about the CAPM and statistics/probability, fill in all the unknown quantities in the table above. To fill in some of these entries, you will need to make an assumption about the correlations between stocks idiosyncratic component of returns. Assume these correlations are zero. (6pt) 3) What is the fraction of Stock A's variance that is explained by the market portfolio? (3pt) 4) Write out the equations that describe the capital market line (CML) and the security market line (SML). Are Stock A, B, and C on CML? Is the market portfolio on CML? And are they on SML? (6pt) You are given the following information on the expected returns, betas, and variance matrix of a group of stocks: Asset E(r) B Covariance Matrix Stock A 0.19 1.25 0.2306 0.1172 Unknown 0.0781 Stock B Unknown 1.50 0.1831 Unknown Unknown Stock C Unknown Unknown 0.3536 0.1250 Mkt Port 0.16 1 0.0625 1) Determine the riskless rate using the information contained in the table above. (3pt) 2) Using what you know about the CAPM and statistics/probability, fill in all the unknown quantities in the table above. To fill in some of these entries, you will need to make an assumption about the correlations between stocks idiosyncratic component of returns. Assume these correlations are zero. (6pt) 3) What is the fraction of Stock A's variance that is explained by the market portfolio? (3pt) 4) Write out the equations that describe the capital market line (CML) and the security market line (SML). Are Stock A, B, and C on CML? Is the market portfolio on CML? And are they on SML? (6pt)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts