Question: You are given the information on three stocks Expected Number of Stock Shares Stock Return 9% 14% 12% 750 220 460 Price Beta $33 $51

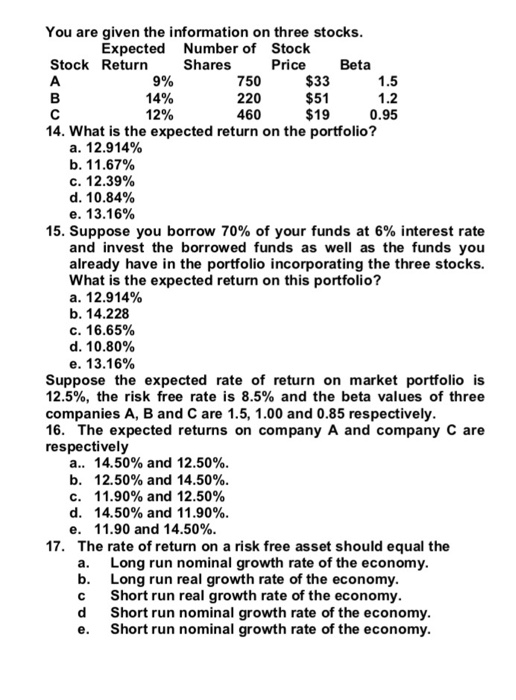

You are given the information on three stocks Expected Number of Stock Shares Stock Return 9% 14% 12% 750 220 460 Price Beta $33 $51 $19 1.5 1.2 0.95 14. What is the expected return on the portfolio? a. 12.914% b. 11.67% c. 12.39% d. 10.84% e. 13.16% 15. Suppose you borrow 70% of your funds at 6% interest rate and invest the borrowed funds as well as the funds you already have in the portfolio incorporating the three stocks. What is the expected return on this portfolio? a. 12.914% b. 14.228 c. 16.65% d. 10.80% e. 13.16% Suppose the expected rate of return on market portfolio is 12.5%, the risk free rate is 8.5% and the beta values of three companies A, B and C are 1.5, 1.00 and 0.85 respectively 16. The expected returns on company A and company C are respectively 14.50% and 12.50%. a. b. 12.50% and 14.50%. 11.90% and 12.50% c. d. 14.50% and 11.90%. e. 11.90 and 14.50% 17. The rate of return on a risk free asset should equal the a. Long run nominal growth rate of the economy b. Long run real growth rate of the economy c Short run real growth rate of the economy d Short run nominal growth rate of the economy e. Short run nominal growth rate of the economy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts