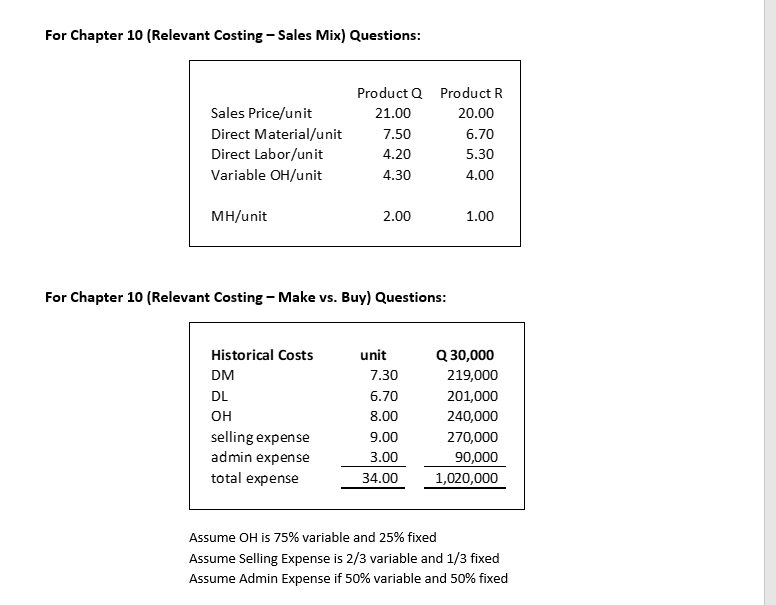

Question: You are given the information under Chapter 10 (Relevant Costing - Make vs. Buy), to produce 30,000 units of a key component of one of

You are given the information under Chapter 10 (Relevant Costing - Make vs. Buy), to produce 30,000 units of a key component of one of your products. Considering the assumptions below the table, what is the relevant cost to produce that component?

Please round your answer to the nearest cent; do not include dollar signs.

Given your answer to the previous question, what would be your managerial decision if an outside supplier could provide the component for 30.00 per unit?

Group of answer choices

make the component

buy the component

not enough information

Given your answer to the previous question, what would be your managerial decision if an outside supplier could provide the component for 25.00 per unit?

Group of answer choices

make the component

buy the component

not enough information

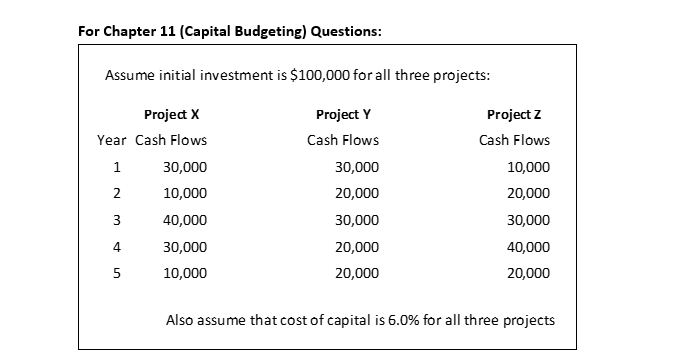

Using the information found under the Chapter 11 (Capital Budgeting) section, please calculate Payback Period (in years) for Project X.

Please round you answer to the nearest hundredth (two decimal places).

Using the information found under the Chapter 11 (Capital Budgeting) section, please calculate Payback Period (in years) for Project Y.

Please round you answer to the nearest hundredth (two decimal places).

Using the information found under the Chapter 11 (Capital Budgeting) section, please calculate Payback Period (in years) for Project Z.

Please round you answer to the nearest hundredth (two decimal places).

Using the information found under the Chapter 11 (Capital Budgeting) section, please calculate Net Present Value (NPV) for Project X.

Please round you answer to the nearest whole dollar, do not use dollar signs and use commas properly.

Using the information found under the Chapter 11 (Capital Budgeting) section, please calculate Net Present Value (NPV) for Project Y.

Please round you answer to the nearest whole dollar, do not use dollar signs and use commas properly.

Using the information found under the Chapter 11 (Capital Budgeting) section, please calculate Net Present Value (NPV) for Project Z.

Please round you answer to the nearest whole dollar, do not use dollar signs and use commas properly.

Using the information found under the Chapter 11 (Capital Budgeting) section, please calculate Internal Rate of Return (IRR) for Project X.

Please round you answer to the nearest hundredth of a percent (XX.XX%).

Using the information found under the Chapter 11 (Capital Budgeting) section, please calculate Internal Rate of Return (IRR) for Project Y.

Please round you answer to the nearest hundredth of a percent (XX.XX%).

Using the information found under the Chapter 11 (Capital Budgeting) section, please calculate Internal Rate of Return (IRR) for Project Z.

Please round you answer to the nearest hundredth of a percent (XX.XX%).

For Chapter 10 (Relevant Costing - Sales Mix) Questions: Product Q Sales Price/unit 21.00 Direct Material/unit 7.50 Direct Labor/unit 4.20 Variable OH/unit 4.30 MH/unit 2.00 For Chapter 10 (Relevant Costing - Make vs. Buy) Questions: Historical Costs unit Q30,000 DM 7.30 219,000 DL 6.70 201,000 OH 8.00 240,000 selling expense 9.00 270,000 admin expense 3.00 90,000 total expense 34.00 1,020,000 Assume OH is 75% variable and 25% fixed Assume Selling Expense is 2/3 variable and 1/3 fixed Assume Admin Expense if 50% variable and 50% fixed Product R 20.00 6.70 5.30 4.00 1.00 For Chapter 11 (Capital Budgeting) Questions: Assume initial investment is $100,000 for all three projects: Project X Project Y Project Z Year Cash Flows Cash Flows Cash Flows 1 30,000 30,000 10,000 2 10,000 20,000 20,000 3 40,000 30,000 30,000 4 30,000 20,000 40,000 5 10,000 20,000 20,000 Also assume that cost of capital is 6.0% for all three projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts