Question: . . You are in the third year as founder of the startup firm that markets specific testing equipment for the oil and gas industry.

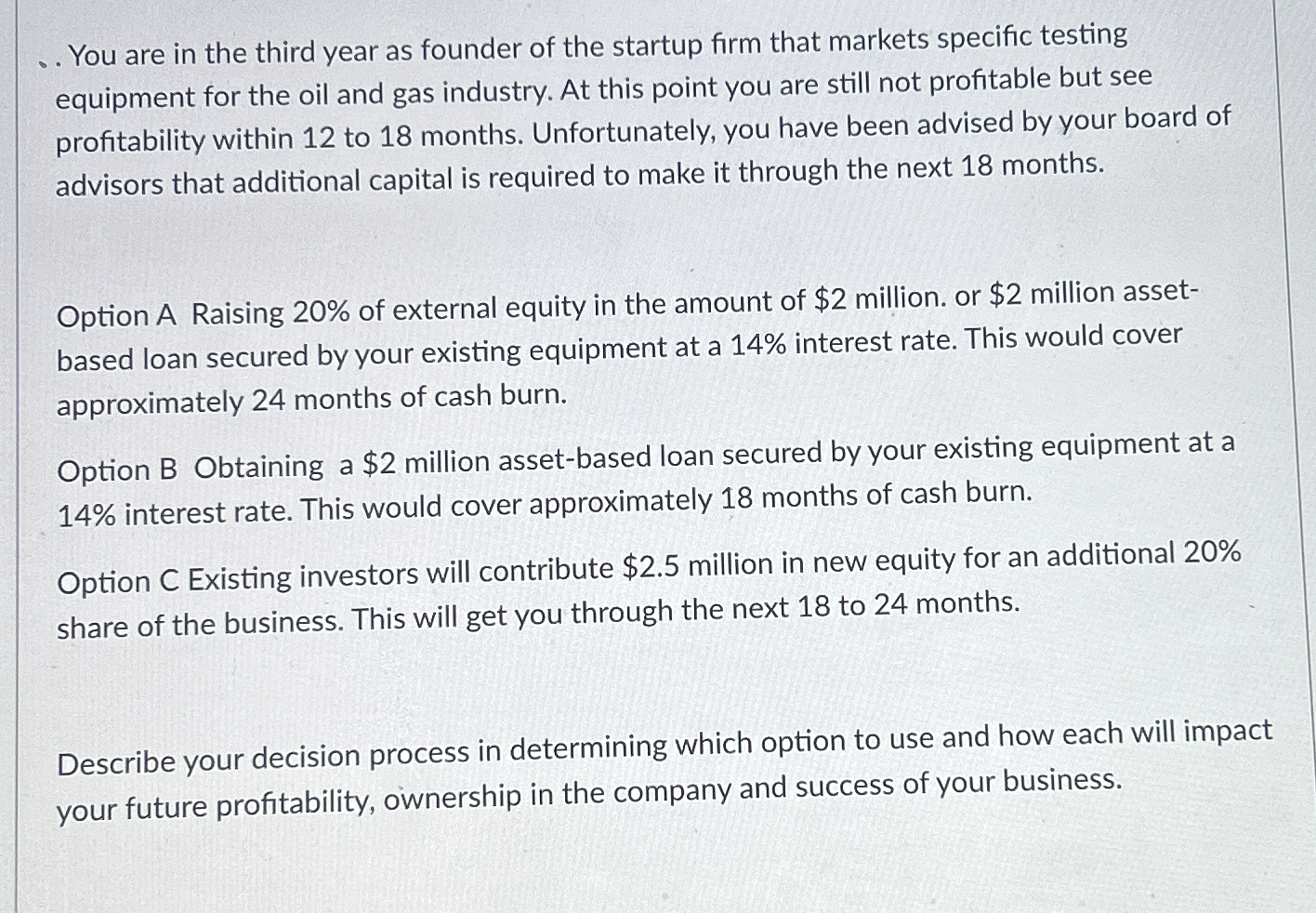

You are in the third year as founder of the startup firm that markets specific testing equipment for the oil and gas industry. At this point you are still not profitable but see profitability within to months. Unfortunately, you have been advised by your board of advisors that additional capital is required to make it through the next months.

Option A Raising of external equity in the amount of $ million. or $ million assetbased loan secured by your existing equipment at a interest rate. This would cover approximately months of cash burn.

Option B Obtaining a $ million assetbased loan secured by your existing equipment at a interest rate. This would cover approximately months of cash burn.

Option C Existing investors will contribute $ million in new equity for an additional share of the business. This will get you through the next to months.

Describe your decision process in determining which option to use and how each will impact your future profitability, ownership in the company and success of your business.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock