Question: you are operating an old machine that is expected to produce annual net cash inflow of 4000 You are operating an old machine that is

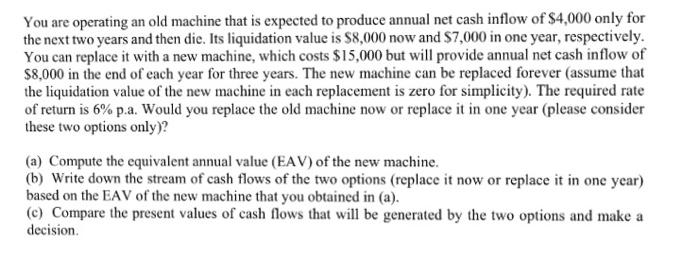

You are operating an old machine that is expected to produce annual net cash inflow of $4,000 only for the next two years and then die. Its liquidation value is $8,000 now and $7,000 in one year, respectively You can replace it with a new machine, which costs $15,000 but will provide annual net cash inflow of $8,000 in the end of each year for three years. The new machine can be replaced forever (assume that the liquidation value of the new machine in each replacement is zero for simplicity). The required rate of return is 6% p.a. Would you replace the old machine now or replace it in one year (please consider these two options only)? (a) Compute the equivalent annual value (EAV) of the new machine (b Write down the stream of cash flows of the two options (replace it now or replace it in one year) based on the EAV of the new machine that you obtained in (a) ows e a decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts