Question: You are planning to replace an old machine in your firm with a cutting-edge technology machine. The project is expected to last six years.

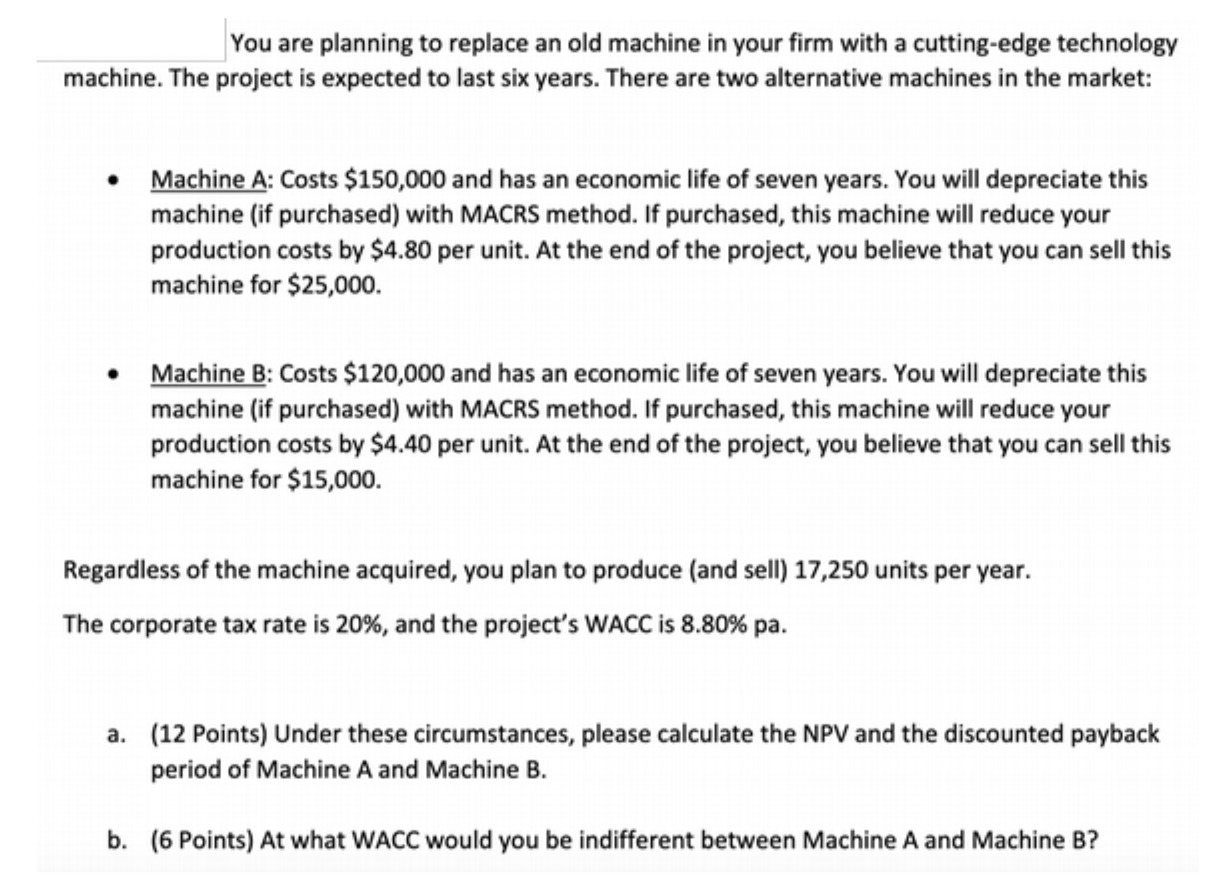

You are planning to replace an old machine in your firm with a cutting-edge technology machine. The project is expected to last six years. There are two alternative machines in the market: Machine A: Costs $150,000 and has an economic life of seven years. You will depreciate this machine (if purchased) with MACRS method. If purchased, this machine will reduce your production costs by $4.80 per unit. At the end of the project, you believe that you can sell this machine for $25,000. Machine B: Costs $120,000 and has an economic life of seven years. You will depreciate this machine (if purchased) with MACRS method. If purchased, this machine will reduce your production costs by $4.40 per unit. At the end of the project, you believe that you can sell this machine for $15,000. Regardless of the machine acquired, you plan to produce (and sell) 17,250 units per year. The corporate tax rate is 20%, and the project's WACC is 8.80% pa. a. (12 Points) Under these circumstances, please calculate the NPV and the discounted payback period of Machine A and Machine B. b. (6 Points) At what WACC would you be indifferent between Machine A and Machine B?

Step by Step Solution

There are 3 Steps involved in it

a NPV calculations for Machine A and B Machine A Cost 150000 Life 7 years Salvage v... View full answer

Get step-by-step solutions from verified subject matter experts