Question: You are presented with the following data from Jake Doyle Inc. for the year ended 31 December 20X. Additional information: a. Sold property, plant, and

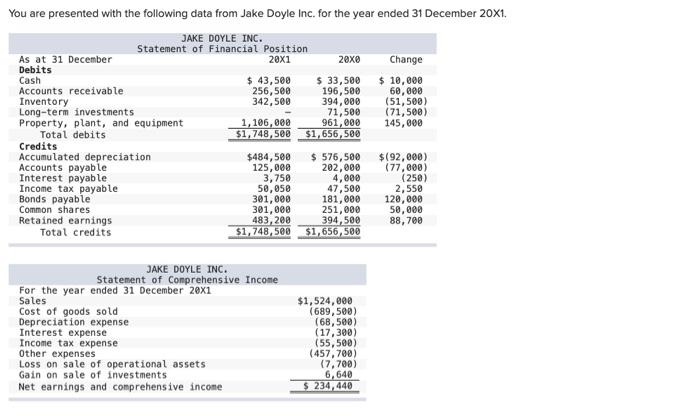

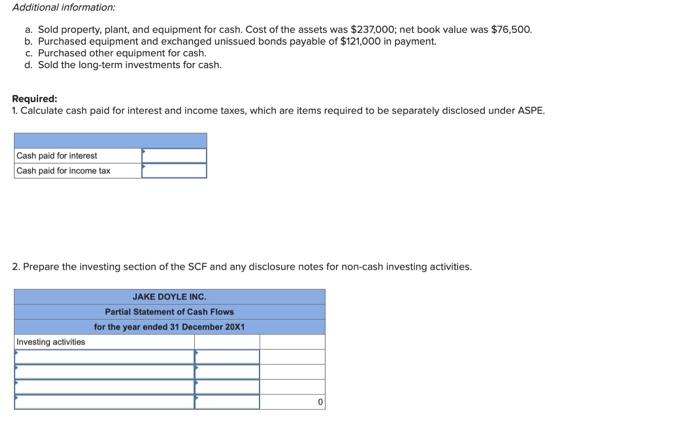

You are presented with the following data from Jake Doyle Inc. for the year ended 31 December 20X. Additional information: a. Sold property, plant, and equipment for cash. Cost of the assets was $237,000; net book value was $76,500. b. Purchased equipment and exchanged unissued bonds payable of $121,000 in payment. c. Purchased other equipment for cash. d. Sold the long-term investments for cash. Required: 1. Calculate cash paid for interest and income taxes, which are items required to be separately disclosed under ASPE. 2. Prepare the investing section of the SCF and any disclosure notes for non-cash investing activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts