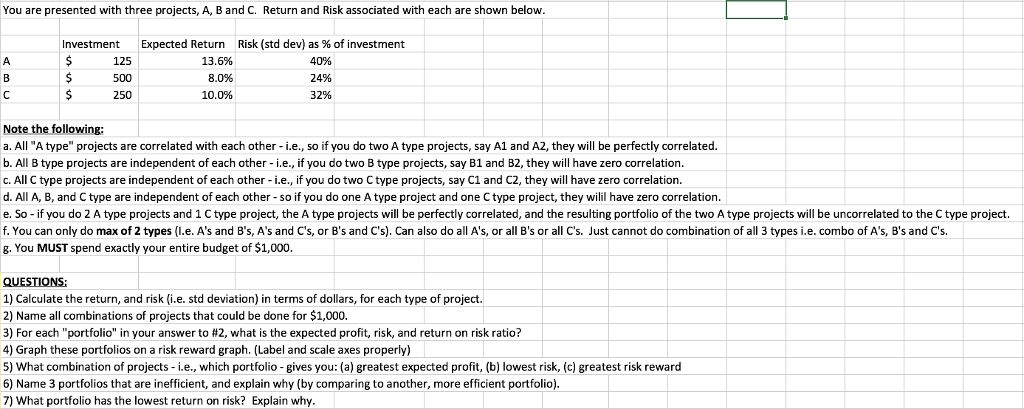

Question: You are presented with three projects, A, B and C. Return and Risk associated with each are shown below Expected Return Risk (std dev) as

You are presented with three projects, A, B and C. Return and Risk associated with each are shown below Expected Return Risk (std dev) as % of investment 40% 24% 32% Investment 125 500 250 13.6% 8.0% 10.0% Note the following: a. All "A type" projects are correlated with each other i.e., so if you do two A type projects, say A1 and A2, they will be perfectly correlated b. All B type projects are independent of each other - i.e., if you do two B type projects, say B1 and B2, they will have zero correlation. c. All C type projects are independent of each other -i.e., if you do two C type projects, say C1 and C2, they will have zero correlation. d. All A, B, and C type are independent of each other so if you do one A type project and one C type project, they wilil have zero correlation. e. So - if you do 2 A type projects and 1 C type project, the A type projects will be perfectly correlated, and the resulting portfolio of the two A type projects will be uncorrelated to the C type project. f. You can only do max of 2 types (l.e. A's and B's, A's and C's, or B's and C's). Can also do all A's, or all B's or all C's. Just cannot do combination of all 3 types i.e. combo of A's, B's and C's. g. You MUST spend exactly your entire budget of $1,000 1) Calculate the return, and risk (i.e. std deviation) in terms of dollars, for each type of project. 2) Name all combinations of projects that could be done for $1,000. 3) For each "portfolio" in your answer to #2, what is the expected profit, risk and return on risk ratio? 4) Graph these portfolios on a risk reward graph. (Label and scale axes properly) 5) What combination of projects i.e., which portfolio - gives you: (a) greatest expected profit, (b) lowest risk, (c) greatest risk reward 6) Name 3 portfolios that are inefficient, and explain why (by comparing to another, more efficient portfolio). 7) What portfolio has the lowest return on risk? Explain why You are presented with three projects, A, B and C. Return and Risk associated with each are shown below Expected Return Risk (std dev) as % of investment 40% 24% 32% Investment 125 500 250 13.6% 8.0% 10.0% Note the following: a. All "A type" projects are correlated with each other i.e., so if you do two A type projects, say A1 and A2, they will be perfectly correlated b. All B type projects are independent of each other - i.e., if you do two B type projects, say B1 and B2, they will have zero correlation. c. All C type projects are independent of each other -i.e., if you do two C type projects, say C1 and C2, they will have zero correlation. d. All A, B, and C type are independent of each other so if you do one A type project and one C type project, they wilil have zero correlation. e. So - if you do 2 A type projects and 1 C type project, the A type projects will be perfectly correlated, and the resulting portfolio of the two A type projects will be uncorrelated to the C type project. f. You can only do max of 2 types (l.e. A's and B's, A's and C's, or B's and C's). Can also do all A's, or all B's or all C's. Just cannot do combination of all 3 types i.e. combo of A's, B's and C's. g. You MUST spend exactly your entire budget of $1,000 1) Calculate the return, and risk (i.e. std deviation) in terms of dollars, for each type of project. 2) Name all combinations of projects that could be done for $1,000. 3) For each "portfolio" in your answer to #2, what is the expected profit, risk and return on risk ratio? 4) Graph these portfolios on a risk reward graph. (Label and scale axes properly) 5) What combination of projects i.e., which portfolio - gives you: (a) greatest expected profit, (b) lowest risk, (c) greatest risk reward 6) Name 3 portfolios that are inefficient, and explain why (by comparing to another, more efficient portfolio). 7) What portfolio has the lowest return on risk? Explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts