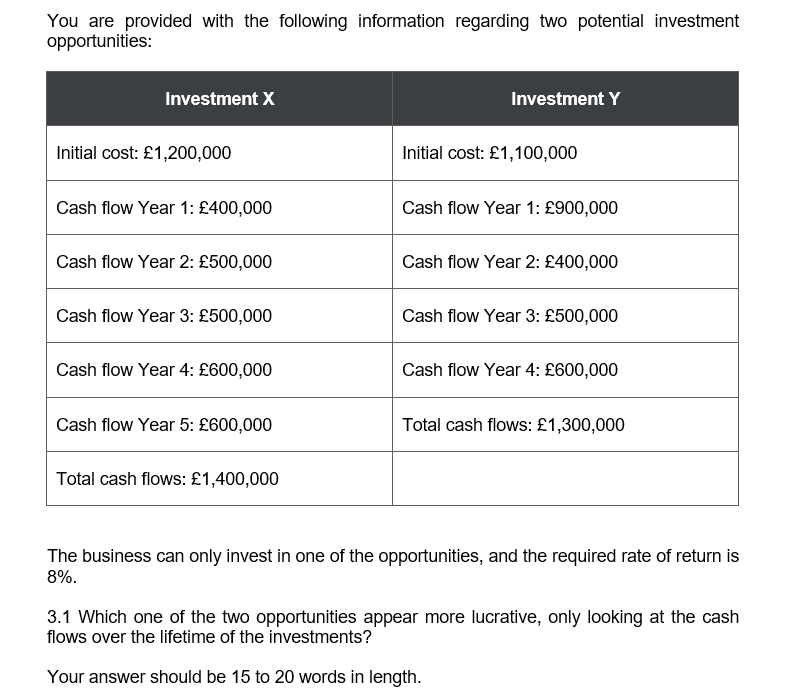

Question: You are provided with the following information regarding two potential investment opportunities: Investment x Investment Y Initial cost: 1,200,000 Initial cost: 1,100,000 Cash flow Year

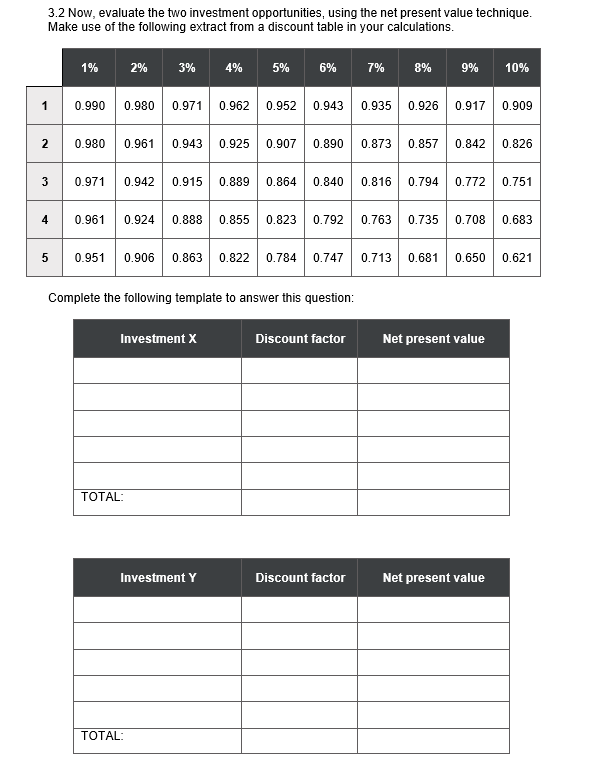

You are provided with the following information regarding two potential investment opportunities: Investment x Investment Y Initial cost: 1,200,000 Initial cost: 1,100,000 Cash flow Year 1: 400,000 Cash flow Year 1: 900,000 Cash flow Year 2: 500,000 Cash flow Year 2: 400,000 Cash flow Year 3: 500,000 Cash flow Year 3: 500,000 Cash flow Year 4: 600,000 Cash flow Year 4: 600,000 Cash flow Year 5: 600,000 Total cash flows: 1,300,000 Total cash flows: 1,400,000 The business can only invest in one of the opportunities, and the required rate of return is 8%. 3.1 Which one of the two opportunities appear more lucrative, only looking at the cash flows over the lifetime of the investments? Your answer should be 15 to 20 words in length. 3.2 Now, evaluate the two investment opportunities, using the net present value technique. Make use of the following extract from a discount table in your calculations. 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 3 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 4 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 Complete the following template to answer this question: Investment X Discount factor Net present value TOTAL: Investment Y Discount factor Net present value TOTAL: 3.3 Based on the calculations performed in 3.2, which one of the two investments should the business pursue? Justify your answer. Your answer should be 20 to 30 words in length

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts