Question: You are purchasing a new computer for your office using the store's installment credit plan. The computer cost $5,991.64. You have enough to make a

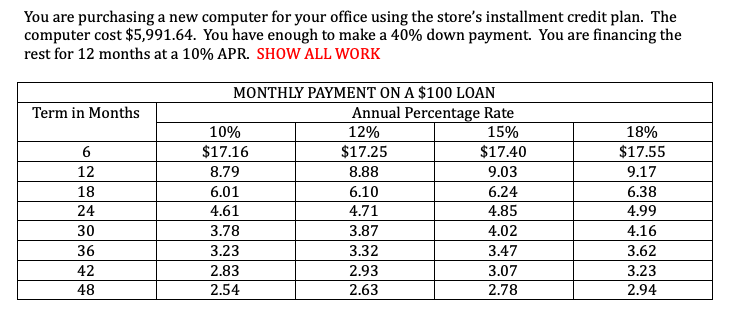

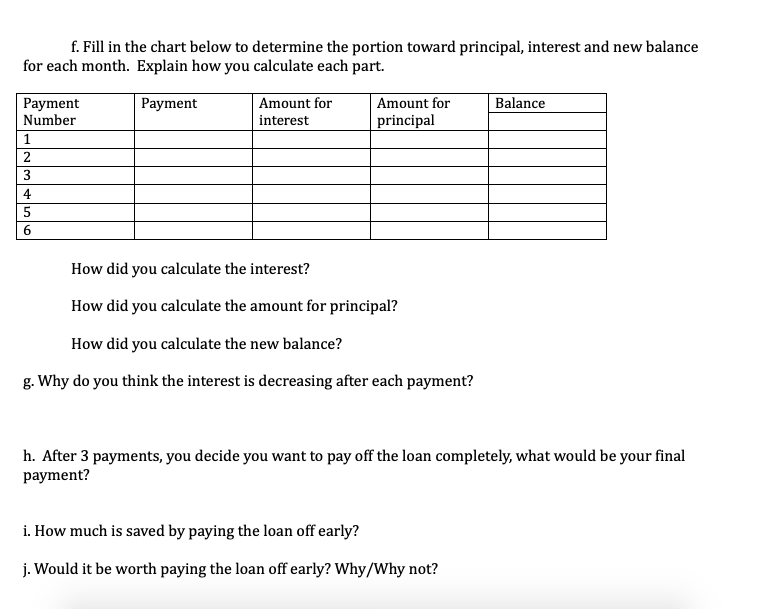

You are purchasing a new computer for your office using the store's installment credit plan. The computer cost $5,991.64. You have enough to make a 40% down payment. You are financing the rest for 12 months at a 10% APR. SHOW ALL WORK Term in Months 6 12 18 24 30 MONTHLY PAYMENT ON A $100 LOAN Annual Percentage Rate 10% 12% 15% $17.16 $17.25 $17.40 8.79 8.88 9.03 6.01 6.10 6.24 4.61 4.71 4.85 3.78 3.87 4.02 3.23 3.32 3.47 2.83 2.93 3.07 2.54 2.63 2.78 18% $17.55 9.17 6.38 4.99 4.16 3.62 3.23 2.94 36 42 48 f. Fill in the chart below to determine the portion toward principal, interest and new balance for each month. Explain how you calculate each part. Payment Balance Amount for interest Amount for principal Payment Number 1 2 3 4 5 6 How did you calculate the interest? How did you calculate the amount for principal? How did you calculate the new balance? g. Why do you think the interest is decreasing after each payment? h. After 3 payments, you decide you want to pay off the loan completely, what would be your final payment? i. How much is saved by paying the loan off early? j. Would it be worth paying the loan off early? Why/Why not? You are purchasing a new computer for your office using the store's installment credit plan. The computer cost $5,991.64. You have enough to make a 40% down payment. You are financing the rest for 12 months at a 10% APR. SHOW ALL WORK Term in Months 6 12 18 24 30 MONTHLY PAYMENT ON A $100 LOAN Annual Percentage Rate 10% 12% 15% $17.16 $17.25 $17.40 8.79 8.88 9.03 6.01 6.10 6.24 4.61 4.71 4.85 3.78 3.87 4.02 3.23 3.32 3.47 2.83 2.93 3.07 2.54 2.63 2.78 18% $17.55 9.17 6.38 4.99 4.16 3.62 3.23 2.94 36 42 48 f. Fill in the chart below to determine the portion toward principal, interest and new balance for each month. Explain how you calculate each part. Payment Balance Amount for interest Amount for principal Payment Number 1 2 3 4 5 6 How did you calculate the interest? How did you calculate the amount for principal? How did you calculate the new balance? g. Why do you think the interest is decreasing after each payment? h. After 3 payments, you decide you want to pay off the loan completely, what would be your final payment? i. How much is saved by paying the loan off early? j. Would it be worth paying the loan off early? Why/Why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts