Question: You are requested to develop a program to calculate the income tax for the user as shown in fig 1. The income tax is charged

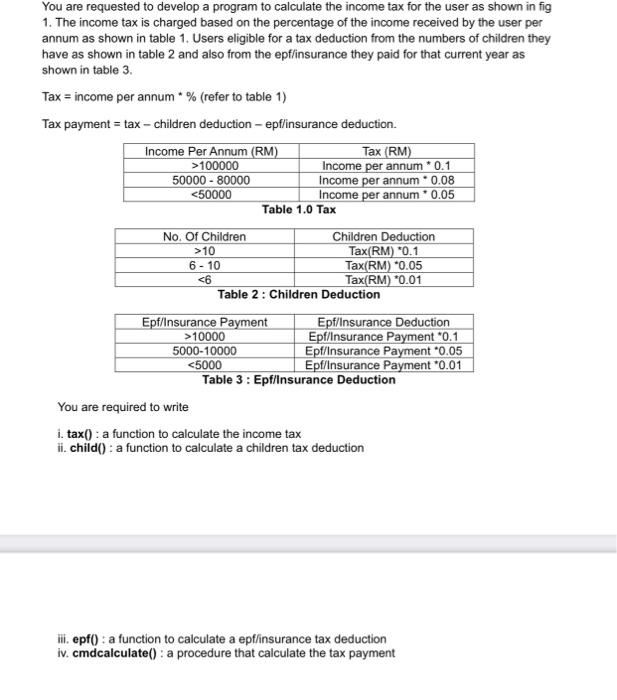

You are requested to develop a program to calculate the income tax for the user as shown in fig 1. The income tax is charged based on the percentage of the income received by the user per annum as shown in table 1. Users eligible for a tax deduction from the numbers of children they have as shown in table 2 and also from the epf/insurance they paid for that current year as shown in table 3. Tax = income per annum * % (refer to table 1) Tax payment = tax - Children deduction - epflinsurance deduction Income Per Annum (RM) Tax (RM) >100000 Income per annum * 0.1 50000 - 80000 Income per annum 0.08 10000 Epf/Insurance Payment *0.1 5000-10000 Epf/Insurance Payment -0.05 10 ii. epf(): a function to calculate a epf/insurance tax deduction IV. cmdcalculate(): a procedure that calculate the tax payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts