Question: You are required to analyze SEEK Limited (Eikon Code: SEK.AX) and prepare an investment recommendation report. The report provides an assessment of the company's current

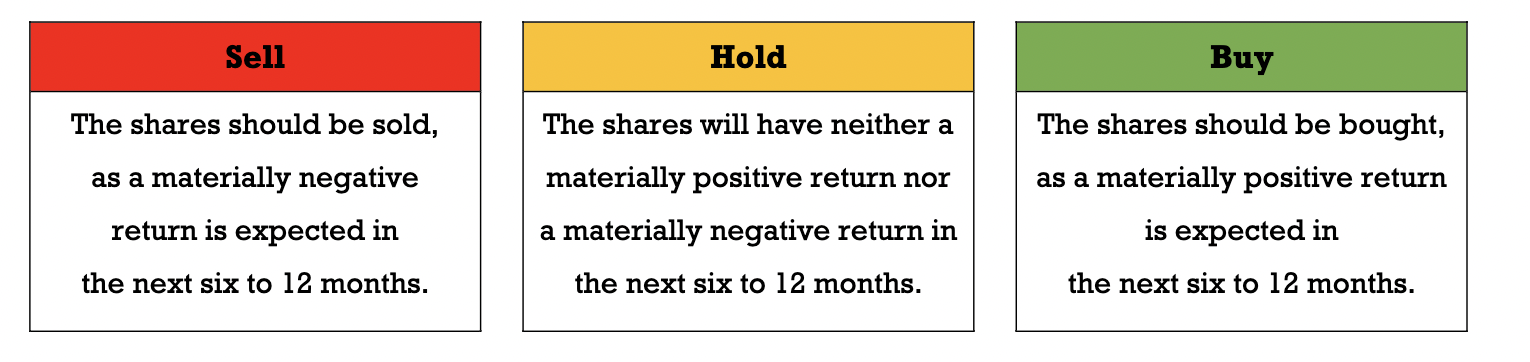

You are required to analyze SEEK Limited (Eikon Code: SEK.AX) and prepare an investment recommendation report. The report provides an assessment of the company's current position and future prospects, incorporating the use of various valuation techniques to arrive at estimates of the intrinsic value of the company's shares. Your report should make a case for the company's shares to be rated in one of the following ways:

Using the DuPont method estimate the ROE of the company and three major competitors for the most recent five years. DuPont Analysis should be done using the 3-step procedure 3 steps: Net Profit Margin, Total Asset Turnover and Financial Leverage analyse the companys and your selected peer companies ROEs over the period show your own calculations for each component over the previous five years for the company and its three selected competitors compare the DuPont ROE of the company with its three peer group companies analyse and comment on the reasons for the change in ROE for the firm and its competitors with reference to the difference in the three components over five years relevant charts/graphs should be used to illustrate these figures

Using the DuPont method estimate the ROE of the company and three major competitors for the most recent five years. DuPont Analysis should be done using the 3-step procedure 3 steps: Net Profit Margin, Total Asset Turnover and Financial Leverage analyse the companys and your selected peer companies ROEs over the period show your own calculations for each component over the previous five years for the company and its three selected competitors compare the DuPont ROE of the company with its three peer group companies analyse and comment on the reasons for the change in ROE for the firm and its competitors with reference to the difference in the three components over five years relevant charts/graphs should be used to illustrate these figures

Sell The shares should be sold, as a materially negative return is expected in the next six to 12 months. Hold The shares will have neither a materially positive return nor a materially negative return in the next six to 12 months. Buy The shares should be bought, as a materially positive return is expected in the next six to 12 months. Sell The shares should be sold, as a materially negative return is expected in the next six to 12 months. Hold The shares will have neither a materially positive return nor a materially negative return in the next six to 12 months. Buy The shares should be bought, as a materially positive return is expected in the next six to 12 months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts