Question: You are required to answer Assignment 1 and Assignment 2. Answer all the questions and show your detailed workings clearly. You have to submit both

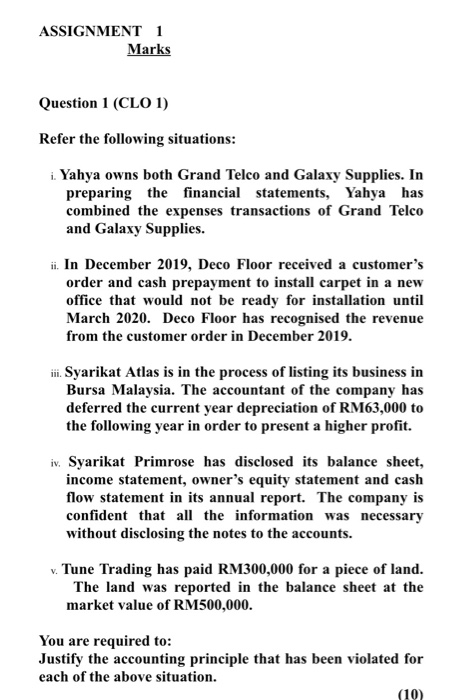

ASSIGNMENT 1 Marks Question 1 (CLO 1) Refer the following situations: i. Yahya owns both Grand Telco and Galaxy Supplies. In preparing the financial statements, Yahya has combined the expenses transactions of Grand Telco and Galaxy Supplies. ii. In December 2019, Deco Floor received a customer's order and cash prepayment to install carpet in a new office that would not be ready for installation until March 2020. Deco Floor has recognised the revenue from the customer order in December 2019. ii. Syarikat Atlas is in the process of listing its business in Bursa Malaysia. The accountant of the company has deferred the current year depreciation of RM63,000 to the following year in order to present a higher profit. iv. Syarikat Primrose has disclosed its balance sheet, income statement, owner's equity statement and cash flow statement in its annual report. The company is confident that all the information was necessary without disclosing the notes to the accounts. v. Tune Trading has paid RM300,000 for a piece of land. The land was reported in the balance sheet at the market value of RM500,000. You are required to: Justify the accounting principle that has been violated for each of the above situation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts