Question: You are required to conduct a financial statement analysis for Eastman Chemical Company Please check you have all the highlighted cells filled with formulas (no

You are required to conduct a financial statement analysis for Eastman Chemical Company

Please check you have all the highlighted cells filled with formulas (no typed value)

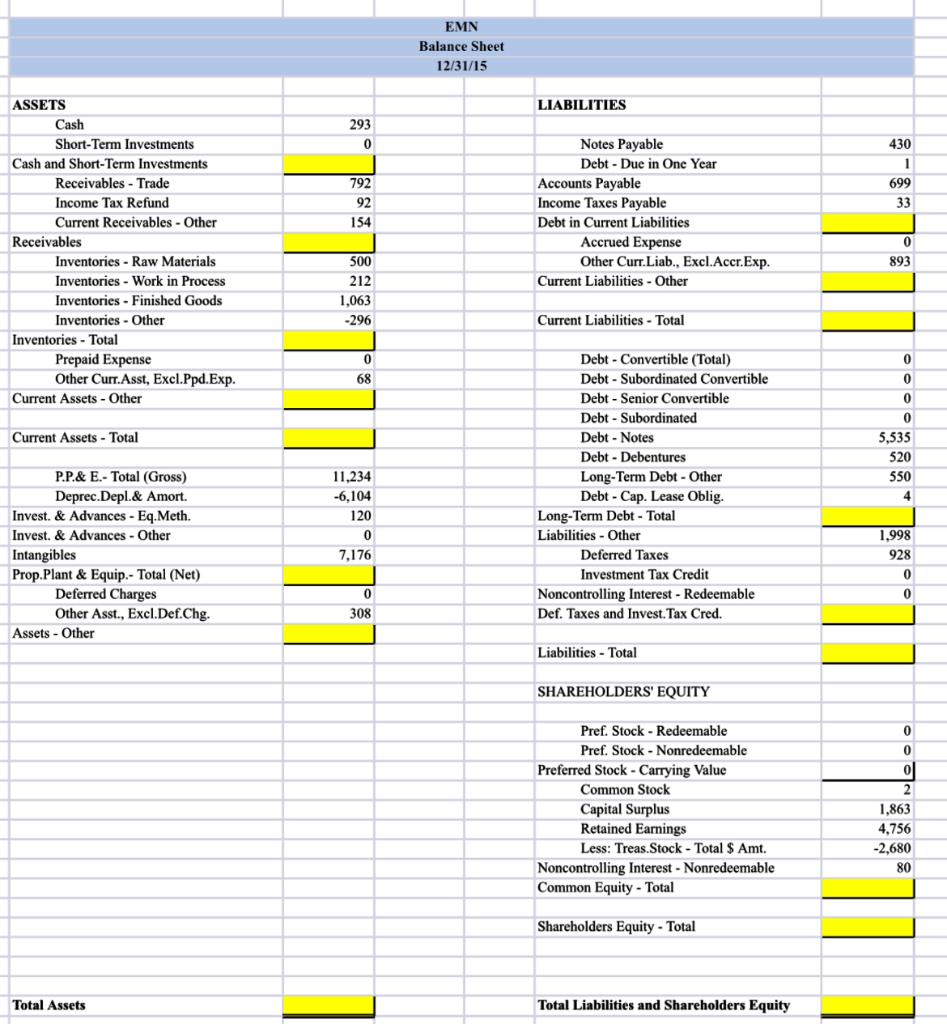

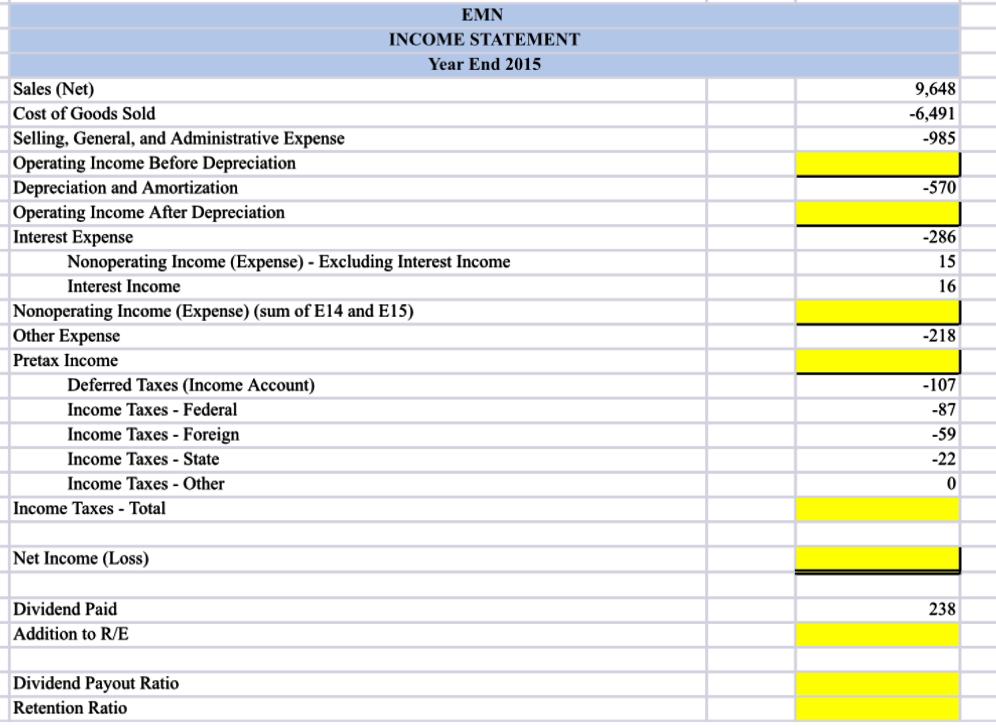

1.Complete the balance sheet and income statement of 2015 (i.e., fill in the colored cells)

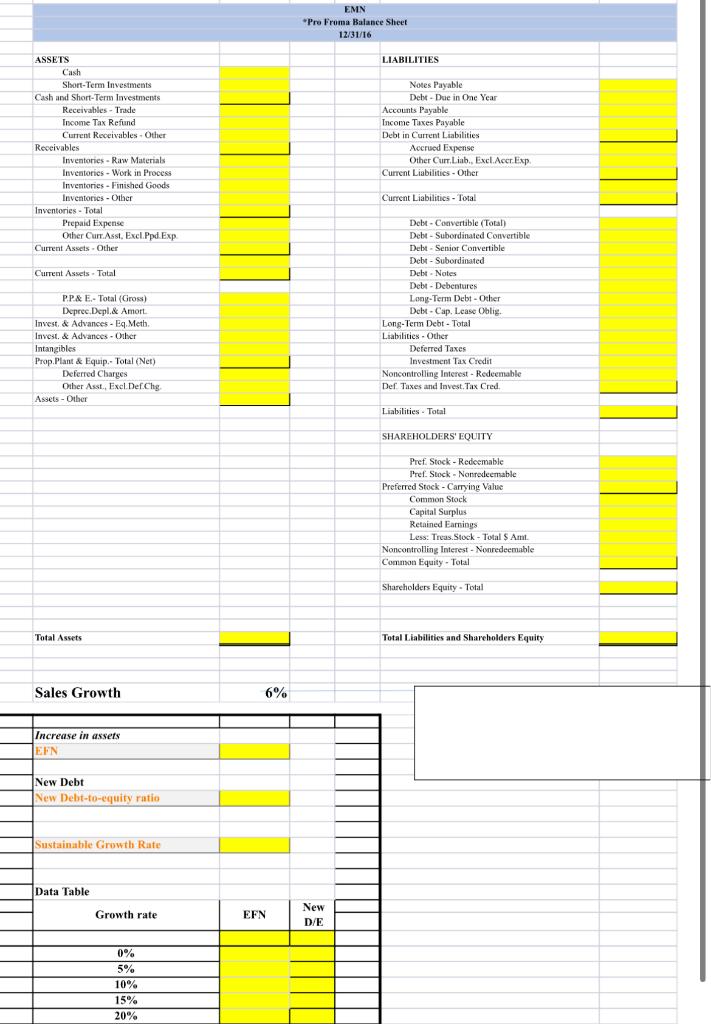

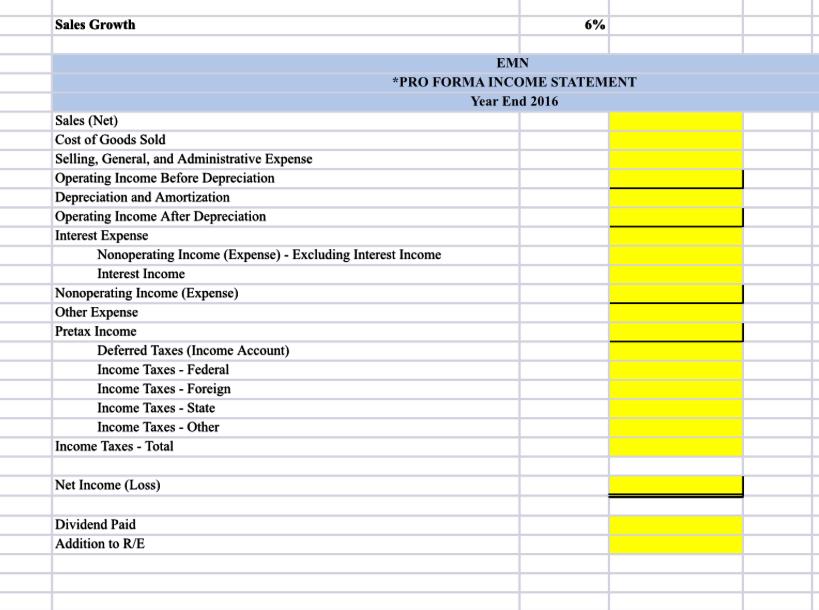

2.Assume sales growth for 2016 is 6%. Construct the Pro Forma income statement and the Pro Forma balance sheet using the percentage of sales approach. Please note:

-Items in the income statement vary directly with sales (increase by the same percentage as sales growth.) except for interest expense, nonoperating income (expense), and interest income. These items will stay the same in the Pro Forma income statement.

-In the balance sheet, all items on the assets side vary directly with sales (increase by the same percentage as sales growth.) In the total liabilities and equity side, only the accounts payable, and income taxes payable vary directly with sales. The other items will stay the same.

3.Calculate external financing needed (EFN)

4.Calculate the new D/E ratio (Long-term debt/total equity) assuming EMN wishes issue no new equity.

5.Build a data table (use Excel What if analysis) to show EFN and new D/E ratio at different sales growth (i.e., 0%, 5%, 10%, 15%, 20%)

6.What is the companys sustainable growth rate?

7.Can EMN eliminate the external financing needed by changing its dividend policy? What other options are available to the company to meet its growth objective?

EMN Balance Sheet 12/31/15 ASSETS LIABILITIES EMN INCOME STATEMENT Year End 2015 Sales (Net) Cost of Goods Sold Selling, General, and Administrative Expense 9,6486,491985 Operating Income Before Depreciation Depreciation and Amortization Operating Income After Depreciation Interest Expense Nonoperating Income (Expense) - Excluding Interest Income Interest Income Nonoperating Income (Expense) (sum of E14 and E15) Other Expense Pretax Income Deferred Taxes (Income Account) Income Taxes - Federal Income Taxes - Foreign Income Taxes - State Income Taxes - Other Income Taxes - Total Net Income (Loss) Dividend Paid 238 Addition to R/E Dividend Payout Ratio Retention Ratio Sales Growth 6% EMN *PRO FORMA INCOME STATEMENT Year End 2016 Sales (Net) Cost of Goods Sold Selling, General, and Administrative Expense Operating Income Before Depreciation Depreciation and Amortization Operating Income After Depreciation Interest Expense Nonoperating Income (Expense) - Excluding Interest Income Interest Income Nonoperating Income (Expense) Other Expense Pretax Income Deferred Taxes (Income Account) Income Taxes - Federal Income Taxes - Foreign Income Taxes - State Income Taxes - Other Income Taxes - Total Net Income (Loss) Dividend Paid Addition to R/E EMN Balance Sheet 12/31/15 ASSETS LIABILITIES EMN INCOME STATEMENT Year End 2015 Sales (Net) Cost of Goods Sold Selling, General, and Administrative Expense 9,6486,491985 Operating Income Before Depreciation Depreciation and Amortization Operating Income After Depreciation Interest Expense Nonoperating Income (Expense) - Excluding Interest Income Interest Income Nonoperating Income (Expense) (sum of E14 and E15) Other Expense Pretax Income Deferred Taxes (Income Account) Income Taxes - Federal Income Taxes - Foreign Income Taxes - State Income Taxes - Other Income Taxes - Total Net Income (Loss) Dividend Paid 238 Addition to R/E Dividend Payout Ratio Retention Ratio Sales Growth 6% EMN *PRO FORMA INCOME STATEMENT Year End 2016 Sales (Net) Cost of Goods Sold Selling, General, and Administrative Expense Operating Income Before Depreciation Depreciation and Amortization Operating Income After Depreciation Interest Expense Nonoperating Income (Expense) - Excluding Interest Income Interest Income Nonoperating Income (Expense) Other Expense Pretax Income Deferred Taxes (Income Account) Income Taxes - Federal Income Taxes - Foreign Income Taxes - State Income Taxes - Other Income Taxes - Total Net Income (Loss) Dividend Paid Addition to R/E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts