Question: You are required to prepare a financial plan report for your client. Your report needs to meet all the requirements of the FAIS Act and

You are required to prepare a financial plan report for your client. Your report needs to meet all the

requirements of the FAIS Act and the disclosure requirements of the FAIS General Code of Conduct.

Various questions are posed in the assignment document. Your advice and calculations should be included

in the suggested financial plan structure and sections below.

The financial plan must include the following sections:

A covering letter,

An executive summary of the advice and recommendations,

The compliance documentation in terms of the FAIS Act,

The personal information on which the plan was based,

The analysis and recommendations,

Implementation plan and disclosure of fees, and

Annexures including the calculations on which the recommendations were based.

Please read the case study and prepare a financial plan report that addresses the questions and concerns

of your client as noted below.

FACTS OF THE CASE

The case study provided is based on the sixstep financial planning process. Apply this process by answering

the questions below. There is not necessarily only one way to solve a situation therefore please ensure to

motivate your answers and reflect your calculations in order that the examiner can follow your rationale. When

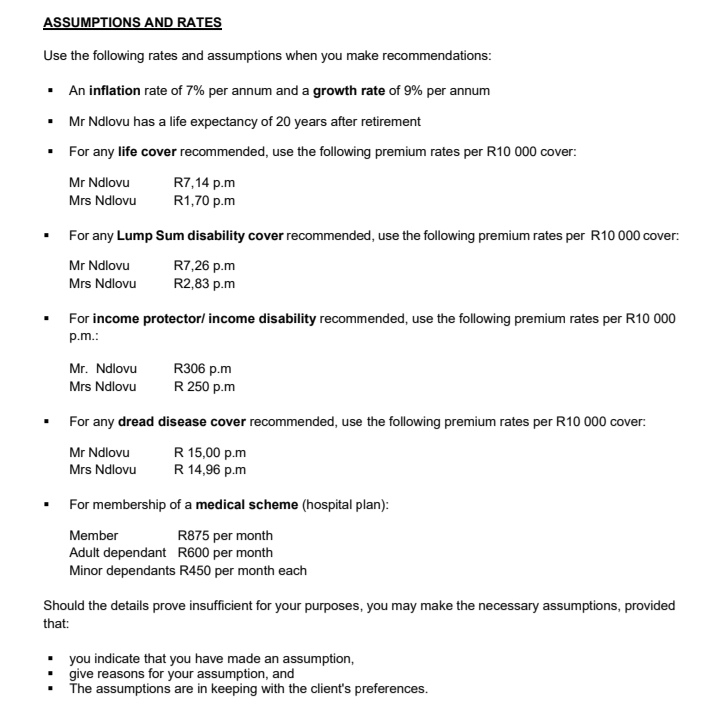

you make recommendations, please use the assumptions and rates provided in the examination paper. If no

assumption is given in the question or the examination paper, you may make an assumption provided you

give a motivation for the assumption. Please do not make unnecessary assumptions.

STEP ONE: ESTABLISHING AND DEFINING THE PROFESSIONAL RELATIONSHIP

You were approached by Mr Ndlovu to assist him and his wife with a comprehensive review of their financial

planning. It is important to clearly explain the services you offer to a prospective client. Once the client has

agreed to engage your business, the relevant disclosure information must be provided to the client and the

applicable customer due diligence as required by the Financial Intelligence Centre Act must be completed.

STEP TWO: GATHERING THE CLIENT'S INFORMATION AND GOALS

You have gathered the following information from Siyabonga and Amahle Ndlovu:

Mr Siyabonga Ndlovu is years old

Mrs Amahle Ndlovu is years old

They are married out of community of property, with the inclusion of the accrual system.

Mr and Mrs Ndlovu have a daughter aged Lesedi and a son of Junior Lesedi was involved in

a car accident and she will be paraplegic for the rest of her life. Junior supports himself.

Mr Ndlovu is an employee of Ndlovu Brothers Pty Ltd He is not a member of a medical scheme and is

thinking of becoming a member. He has never been on a medical aid in his life. He is unsure if there is

any benefit in making his spouse the principal member of the medical aid. His wife was on a scheme for

her whole life until two months ago when she changed bank accounts and forgot to inform the scheme.

As a result of her negligence her membership was terminated.

They have been married for years. When they got married the value of his estate was worth R

and her estate was worth R The CPI factors at date of marriage and currently is and

respectively. Their antenuptial contract agreement states that her investments are excluded from the

accrual.

Mr Siyabonga Ndlovu has the following assets and liabilities:

He also has a fiduciary interest over a holiday flat in Port St Johns. The current market value is R

The fideicommissary is his youngest brother Mpho Ndlovu who has just turned

Mrs Amahle Ndlovu has the following assets and liabilities:

Trusts

The Ndlovu Family Trust, established in South Africa in has the following assets and liabilities:

Life policy on the life of Mr Ndlovu Value R

Shares of Ndlovu Brothers Pty Ltd Value R

The trust deed states that the trustees of the trust are Mr Ndlovu, Mrs Ndlovu and his older brother who is

resident in Dubai. It is a discretionary trust and the beneficiaries are his children.

Business interests

The other two shareholders of Ndlovu Brothers Pty Ltd affected a policy in their personal capacity on the

life of Mr Ndlovu for an amount of R There is no written agreement and Mr Ndlovu informs you

that they indicated that they will not purchase the shares from his trust on his death. They will keep the

proceeds of the policy for themselves. He is concerned about the estate duty and CGT implications.

Last Will and Testament

Mr Ndlovu bequeaths the following:

R cash and the unit trusts CIS to the trust.

The residue of the estate to the spouse.

In the event of his spouse predeceasing him, the whole of his estate is bequeathed to the inter vivos

trust.

Income and Expenses

The family's income and expenses are as follows:

Mr Ndlovu instructed you not to take into account the income and expenses of his spouse. Her income and

expenses is only relevant after his death for her maintenance. Mrs Ndlovu works for her husband

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock