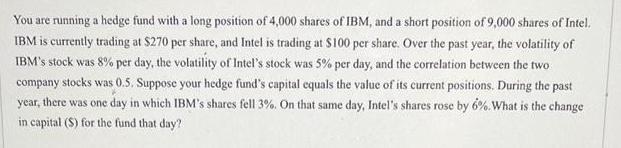

Question: You are running a hedge fund with a long position of 4,000 shares of IBM, and a short position of 9,000 shares of Intel.

You are running a hedge fund with a long position of 4,000 shares of IBM, and a short position of 9,000 shares of Intel. IBM is currently trading at $270 per share, and Intel is trading at $100 per share. Over the past year, the volatility of IBM's stock was 8% per day, the volatility of Intel's stock was 5% per day, and the correlation between the two company stocks was 0.5. Suppose your hedge fund's capital equals the value of its current positions. During the past year, there was one day in which IBM's shares fell 3%. On that same day, Intel's shares rose by 6%. What is the change in capital (S) for the fund that day?

Step by Step Solution

There are 3 Steps involved in it

Portfolio Volatility sqrtWeight1weight1Std1Std1 Weight2weig... View full answer

Get step-by-step solutions from verified subject matter experts