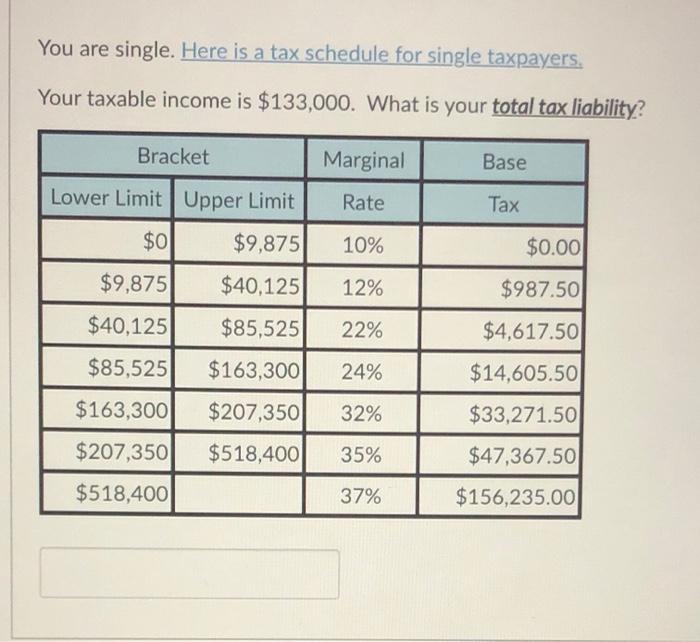

Question: You are single. Here is a tax schedule for single taxpayers. Your taxable income is $133,000. What is your total tax liability? Bracket Marginal Base

You are single. Here is a tax schedule for single taxpayers. Your taxable income is $133,000. What is your total tax liability? Bracket Marginal Base Lower Limit Upper Limit Rate Tax $0 $9,875 10% $0.00 $9,875 $40,125 12% $987.50 $40,125 $85,525 22% $4,617.50 $85,525 $163,300 24% $14,605.50 $163,3001 $207,350 32% $33,271.50 $207,350 $518,400 35% $47,367.50 $518,400 37% $156,235.00

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock