Question: You are tasked with constructing a budget for the upcoming fiscal year. To help you construct this budget you wisely look back on the actual

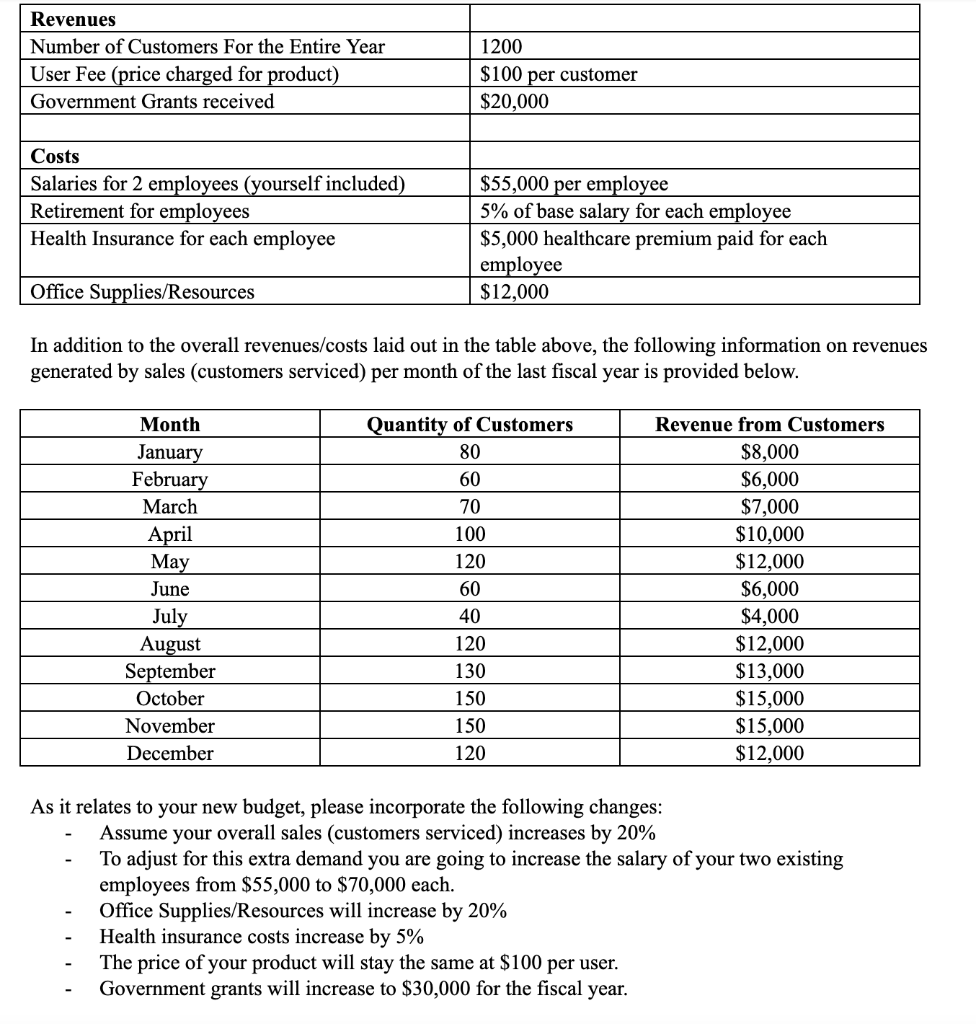

You are tasked with constructing a budget for the upcoming fiscal year. To help you construct this budget you wisely look back on the actual costs/revenue incurred by your firm over the past fiscal year. To simplify things lets assume your firms sells one good and charges a user fee for that good. The information below shows a breakdown of the actual costs/revenues for your firm over the past fiscal year.

Revenues Number of Customers For the Entire Year User Fee (price charged for product) Government Grants received 1200 $100 per customer $20,000 Costs Salaries for 2 employees (yourself included) Retirement for employees Health Insurance for each employee $55,000 per employee 5% of base salary for each employee $5,000 healthcare premium paid for each employee $12,000 Office Supplies/Resources In addition to the overall revenues/costs laid out in the table above, the following information on revenues generated by sales (customers serviced) per month of the last fiscal year is provided below. Month January February March April May June July August September October November December Quantity of Customers 80 60 70 100 120 60 40 120 130 150 150 120 Revenue from Customers $8,000 $6,000 $7,000 $10,000 $12,000 $6,000 $4,000 $12,000 $13,000 $15,000 $15,000 $12,000 As it relates to your new budget, please incorporate the following changes: Assume your overall sales (customers serviced) increases by 20% To adjust for this extra demand you are going to increase the salary of your two existing employees from $55,000 to $70,000 each. Office Supplies/Resources will increase by 20% Health insurance costs increase by 5% The price of your product will stay the same at $100 per user. Government grants will increase to $30,000 for the fiscal year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts