Question: You are tasked with doing Relative Valuation for a shoe manufacturer. The comps are on the table below. The firm's EBITDA is $20 million, it

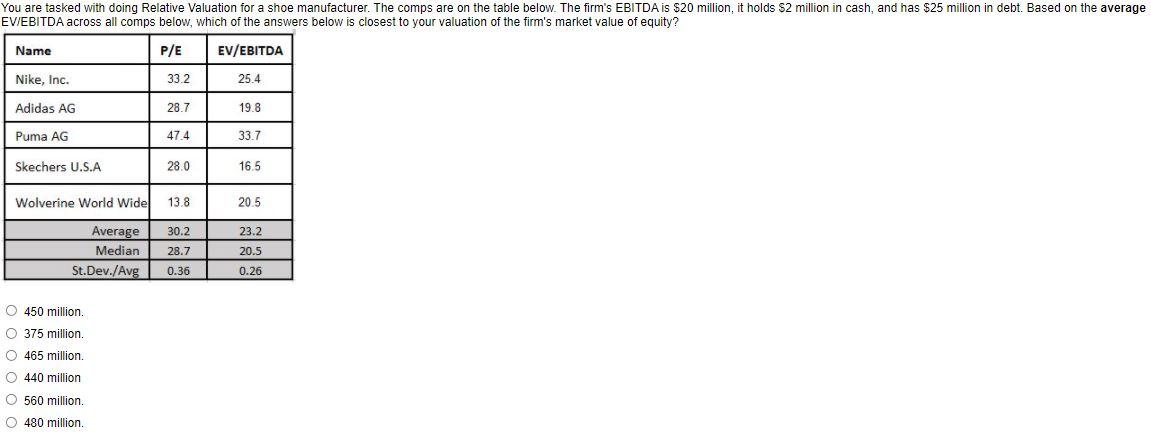

You are tasked with doing Relative Valuation for a shoe manufacturer. The comps are on the table below. The firm's EBITDA is $20 million, it holds $2 million in cash, and has $25 million in debt. Based on the average EV/EBITDA across all comps below, which of the answers below is closest to your valuation of the firm's market value of equity?

You are tasked with doing Relative Valuation for a shoe manufacturer. The comps are on the table below. The firm's EBITDA is $20 million, it holds $2 million in cash, and has $25 million in debt. Based on the average EV/EBITDA across all comps below, which of the answers below is closest to your valuation of the firm's market value of equity? Name P/E EV/EBITDA Nike, Inc. 33.2 25.4 Adidas AG 28.7 19.8 Puma AG 47.4 33.7 Skechers U.S.A 28.0 16.5 Wolverine World Wide 13.8 20.5 23.2 Average Median St.Dev./Avg 30.2 28.7 0.36 20.5 0.26 O 450 million 375 million 0465 million O 440 million O 560 million 480 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts