Question: You are the CFO of Java Express (JEX), Inc., a wholesale roaster and distributor of gourmet coffee. You are currently considering the purchase of

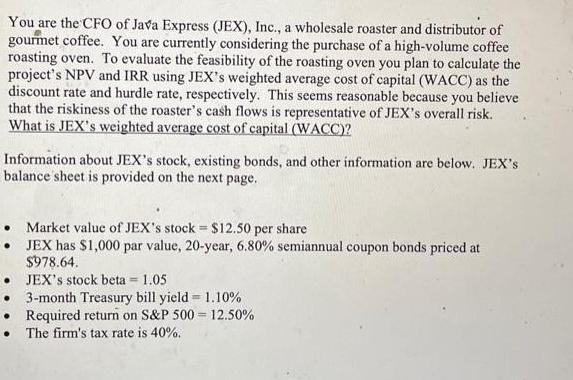

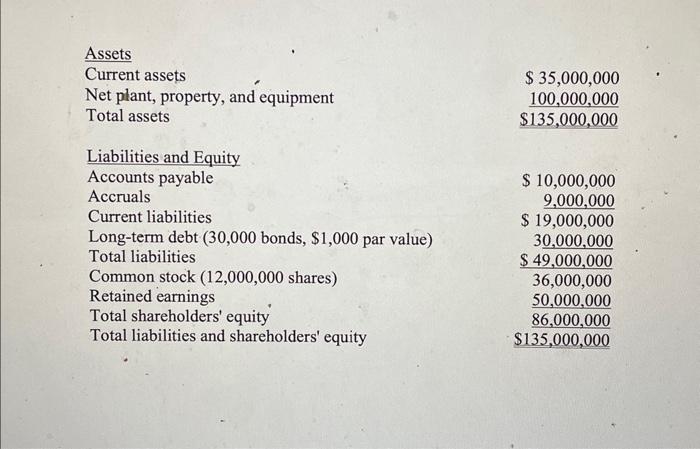

You are the CFO of Java Express (JEX), Inc., a wholesale roaster and distributor of gourmet coffee. You are currently considering the purchase of a high-volume coffee roasting oven. To evaluate the feasibility of the roasting oven you plan to calculate the project's NPV and IRR using JEX's weighted average cost of capital (WACC) as the discount rate and hurdle rate, respectively. This seems reasonable because you believe that the riskiness of the roaster's cash flows is representative of JEX's overall risk. What is JEX's weighted average cost of capital (WACC)? Information about JEX's stock, existing bonds, and other information are below. JEX's balance sheet is provided on the next page. Market value of JEX's stock = $12.50 per share JEX has $1,000 par value, 20-year, 6.80% semiannual coupon bonds priced at $978.64. JEX's stock beta = 1.05 3-month Treasury bill yield = 1.10% Required return on S&P 500= 12.50% The firm's tax rate is 40%. Assets Current assets Net plant, property, and equipment Total assets Liabilities and Equity Accounts payable Accruals Current liabilities Long-term debt (30,000 bonds, $1,000 par value) Total liabilities Common stock (12,000,000 shares) Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $ 35,000,000 100,000,000 $135,000,000 $ 10,000,000 9,000,000 $ 19,000,000 30,000,000 $ 49,000,000 36,000,000 50,000,000 86,000,000 $135,000,000

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Computing the cost of the capital 1 Cost of Debt Cost of Debt YTM 1 Tax rate Thus comp... View full answer

Get step-by-step solutions from verified subject matter experts