Question: You are the project manager at Janson Manufacturing. Feedback from the annual employee?s survey revealed that employees were interested in having a fitness center. Thus,

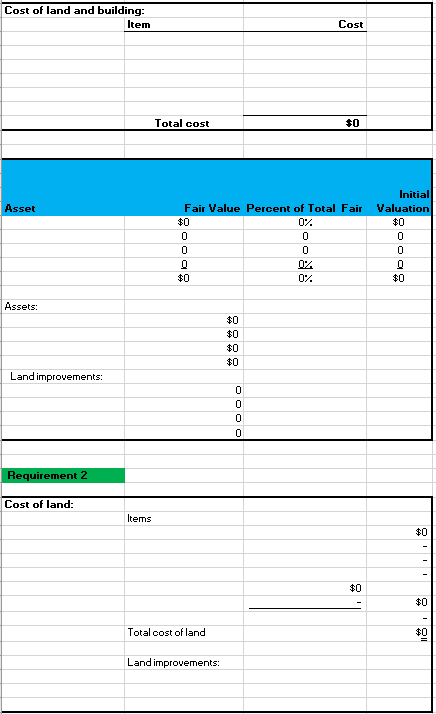

You are the project manager at Janson Manufacturing. Feedback from the annual employee?s survey revealed that employees were interested in having a fitness center. Thus, last week, you closed the deal and purchased land and a building for $6 million. Other expenses incurred in connection to this purchase included:

| Attorney fees for the contract | $10,000 |

| Commissions | 55,000 |

| Title insurance | 8,500 |

| Pro-rated Property taxes | 75,000 |

An independent appraisal was requested to determine the individual fair value estimates. The land appraised at $5.5 million and the building at $1.9 million.

Spending on the property started right away. Janson installed fences and completed the driveway at a cost of $45,000 and $75,000, respectively.

- What is the initial valuation of each asset Janson purchased in these transactions??

- Suppose Janson, immediately after acquiring the property, decided to tear down the building. The cost of the removal of the building was $350,000 and salvaged materials sold for $8,000. An additional $100,000 was paid to grade the land for building the new fitness center. What is the initial valuation of each asset Janson acquired in this transaction??

Cost of land and building: Item Asset Assets: Land improvements: Requirement 2 Cost of land: Items Total cost $0 0 Fair Value Percent of Total Fair 0% 0 0 0 $0 Total cost of land Land improvements: $0 $0 $0 0 OOOO 0 0 0 Cost 0 0% 0% $0 $0 Initial Valuation $0 0 0 0 $0 $0 $0 $0

Step by Step Solution

There are 3 Steps involved in it

To determine the initial valuation we need to allocate the total cost of purchasing the property bet... View full answer

Get step-by-step solutions from verified subject matter experts