Question: You are thinking about purchasing a condominium. The condo is located in Vancouver and its market price is $550,000. You met with the loans

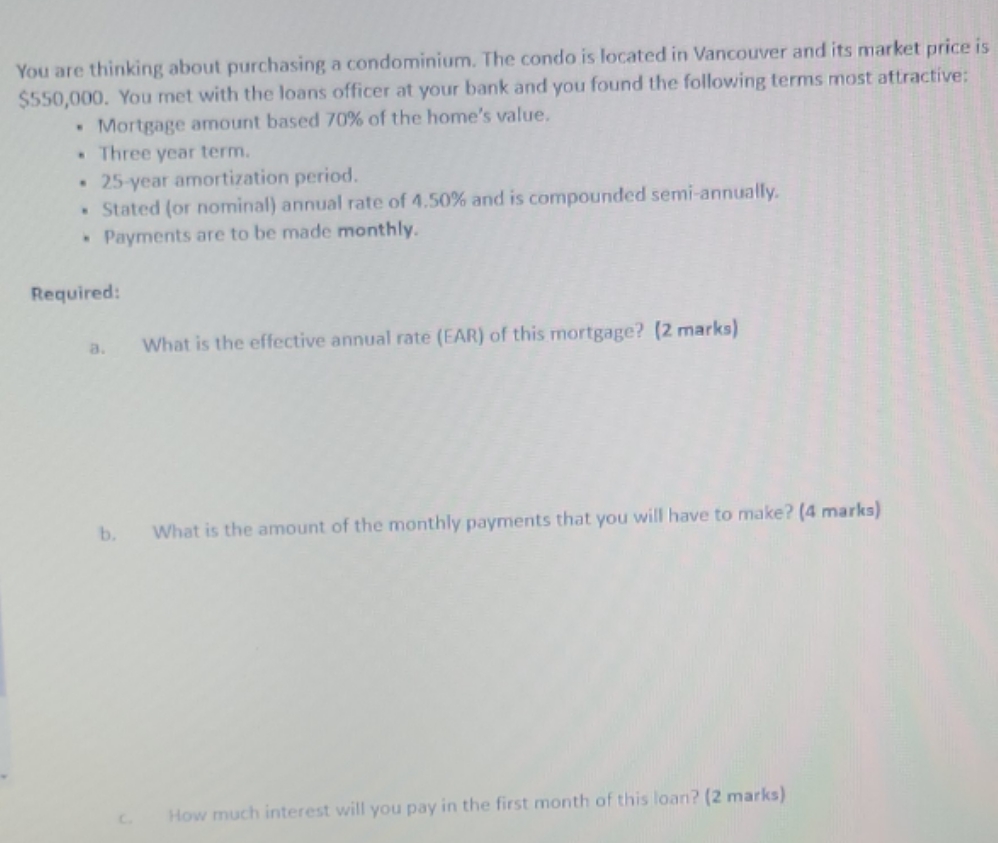

You are thinking about purchasing a condominium. The condo is located in Vancouver and its market price is $550,000. You met with the loans officer at your bank and you found the following terms most attractive: Mortgage amount based 70% of the home's value. Three year term. .25-year amortization period. Stated (or nominal) annual rate of 4.50% and is compounded semi-annually. Payments are to be made monthly. Required: a. What is the effective annual rate (EAR) of this mortgage? (2 marks) b. What is the amount of the monthly payments that you will have to make? (4 marks) How much interest will you pay in the first month of this loan? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

a Effective Annual Rate EAR To calculate the EAR we need to find the effective rate of interest per ... View full answer

Get step-by-step solutions from verified subject matter experts