Question: You are to create a budget based upon the document titled finance assignment #2. Use the excel spreadsheet titled healthcare finance #2 template. Build your

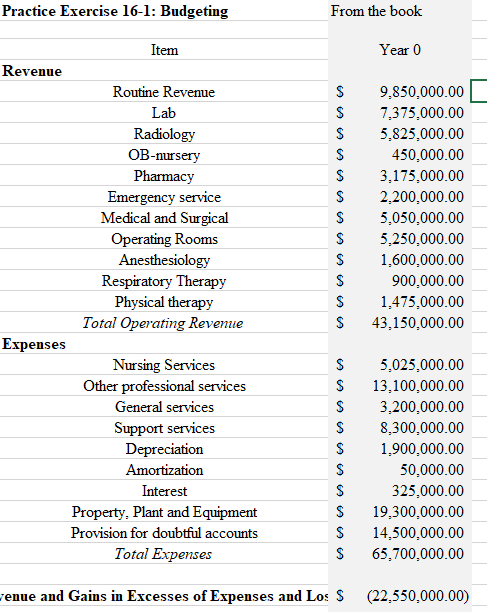

You are to create a budget based upon the document titled finance assignment #2. Use the excel spreadsheet titled healthcare finance #2 template. Build your budget from the data in column 0, forecasting a budget for the next 3 years using the assumptions given.

Create a budget for the next fiscal year (see page 180). In doing your budget, make sure you review checklist 16-2 on page 186 for items to consider.

Items to be included in your budget: The items in the tables on pages 475, 476, 477 (see excel spreadsheet attached to assignment). Your budget is for 3 years and must be adjusted for the following:

a. You hire a new surgeon that will begin doing elective surgeries in year 2. This increases your surgical volume by 10% from year 1 and another 15% in year 3. Surgery patients use operating rooms and anesthesiology services. Surgeon salary is $350,000 per year plus 25% for benefits. Support staff costs for the surgeon are $50,000 in Year 1, $55,000 in Year 2 and $60,000 in year 3.

b. A nearby hospital closes their OB unit and you receive an influx of new patients in year 2. This increases your OB volume by 25% in Year 2 and 30% in Year 3, however, many are uninsured or not able to pay their bills. With this increase, you need to increase the staff costs by 20% per year to care for these patients. The average current revenue per delivery is $15,000. With the increase in uninsured patients, doubtful accounts need to increase by 10% to account for these losses. In year 1, OB Staffing is under other professional services and is 20% of the total amount and total deliveries were 350 in Year 1.

c. You lose half your physical therapists over a contract dispute midway through year 1 and dont get them to return by the end of year 3. One physical therapist creates $49,166.67 per year in revenue (total of 50 therapists) and costs $131,000 under other professional services.

d. CoVid testing is a new source of revenue for your lab and increases your revenue by 50% every year for the next 3 years. You also need to add $20,000 per year for staff to complete the tests (under professional revenue).

e. You build a new Emergency Department, and your visits increase by 25% in year 3. ED patients flow into radiology services, and they also increase by 10%. The new building increases depreciation by $1,000,000 year. No increase in staffing costs in the ED or other services.

Practice Exercise 16-1: Budgeting From the book renue and Gains in Excesses of Expenses and Los $(22,550,000.00) Your projections State any assumptions-or why? \begin{tabular}{l|l|l} Year 1 & Year 2 & Year 3 \end{tabular} Practice Exercise 16-1: Budgeting From the book renue and Gains in Excesses of Expenses and Los $(22,550,000.00) Your projections State any assumptions-or why? \begin{tabular}{l|l|l} Year 1 & Year 2 & Year 3 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts