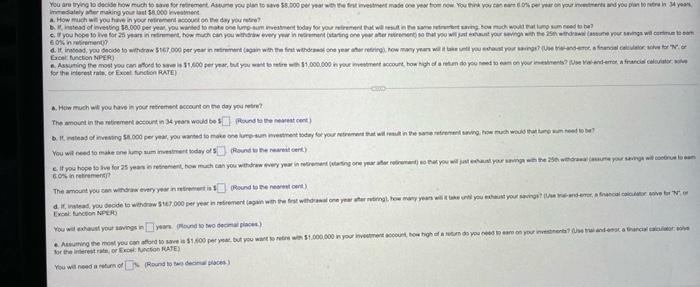

Question: You are trying to decide how much to save for retirement. Assume you plan to save $ 8 , 0 0 0 per year with

You are trying to decide how much to forement une you plan to save 58.000 per year we finestre made one year to now. You kostar on your and you plan to win your dalyer making your last SR.000 met How much will you have in your retirement to the day you are? stead of investing 18.000 per year. You willed to one-tumme today for you want to much wolum um you hope to ve for 25 years in how much can you with very winning on your way with your with the wyour wings will 60% d. It read, you decide to withdraw 167.000 per year in an with the first with one year herrering. How many years will be your ? Une El function NPERI Assuming the most you can word to 1.600 per year, but you want 1.000.000 in your heart out to the man do you can on your name andre france control for the interest rate of Excel funcion RATE) How much will you have in your retroccount one day you? The amount in the retirement account in 3 years would be on the recent Inting 000 per year you wanted to make one day for you trement will result in the same show how to win You will need to make one lump sum is today found to recent) e. If you hope love for your intento much can you why year in retirements or errorehat you will your the win your articolo 60% in retirement The amount you can with every year in Rundert) d. I was you decide to wrow 167.000 per year tirement again with the first with one year agowany years with until you at your order wher Erol function NPER) You will your savings and to two decap Asuming the most you can afford to save $1.500 per year. But you want toute 51.000.000 in your count, high and you came on your needs and for the ECRATES You will need a return of Round to come

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts