Question: You are trying to decide whether to replace a machine on your production line. The new machine will cost $1.25 million but will be

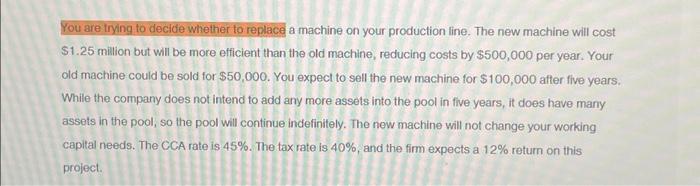

You are trying to decide whether to replace a machine on your production line. The new machine will cost $1.25 million but will be more efficient than the old machine, reducing costs by $500,000 per year. Your old machine could be sold for $50,000. You expect to sell the new machine for $100,000 after five years. While the company does not intend to add any more assets into the pool in five years, it does have many assets in the pool, so the pool will continue indefinitely. The new machine will not change your working capital needs. The CCA rate is 45%. The tax rate is 40%, and the firm expects a 12% return on this project.

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

To decide whether to replace the old machine with the new one you should calculate the Net Present V... View full answer

Get step-by-step solutions from verified subject matter experts