Question: You are trying to develop a strategy for investing in two different stocks. The anticipated annual return for a $1,000 investment in each stock under

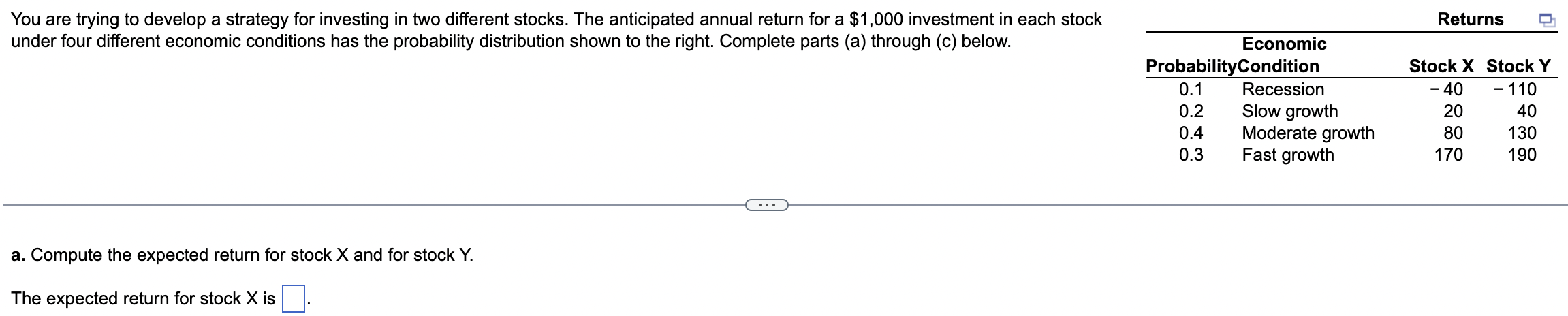

You are trying to develop a strategy for investing in two different stocks. The anticipated annual return for a $1,000 investment in each stock under four different economic conditions has the probability distribution shown to the right. Complete parts (a) through (c) below.

a. Compute the expected return for stock X and for stock Y.

b. Compute the standard deviation for stock X and for stock Y.

c. Would you invest in stock X or stock Y? Explain.

You are trying to develop a strategy for investing in two different stocks. The anticipated annual return for a $1,000 investment in each stock under four different economic conditions has the probability distribution shown to the right. Complete parts (a) through (c) below. Returns a. Compute the expected return for stock X and for stock Y. The expected return for stock X is You are trying to develop a strategy for investing in two different stocks. The anticipated annual return for a $1,000 investment in each stock under four different economic conditions has the probability distribution shown to the right. Complete parts (a) through (c) below. Returns a. Compute the expected return for stock X and for stock Y. The expected return for stock X is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts