Question: You are trying to estimate the beta for a private firm that manufactures home appliances. You have managed to obtain betas for publicly traded firms

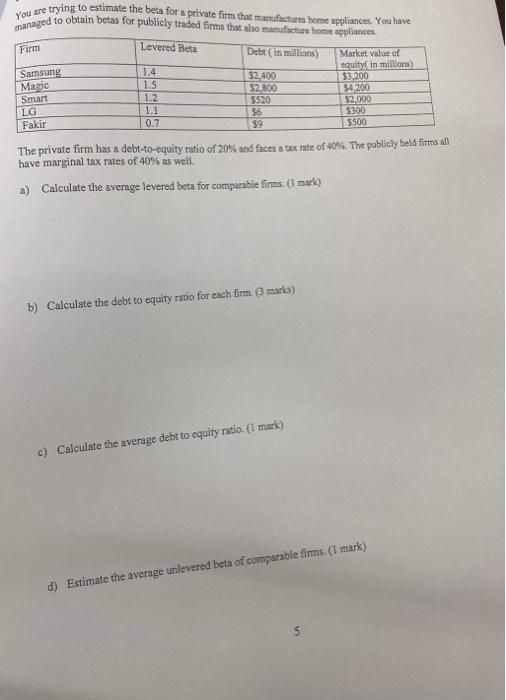

You are trying to estimate the beta for a private firm that manufactures home appliances. You have managed to obtain betas for publicly traded firms that also manufacture home appliances. Firm Samsung Magic Smart LG Fakir Levered Beta 1.4 1.5 1.2 1.1 P-F 0.7 Debt (in millions) $2,400 $2,800 $520 $6 $9 b) Calculate the debt to equity ratio for each firm. (3 marks) Market value of equity in millions) c) Calculate the average debt to equity ratio. (1 mark) $3,200 $4,200 The private firm has a debt-to-equity ratio of 20% and faces a tax rate of 40%. The publicly held firms all have marginal tax rates of 40% as well. a) Calculate the average levered beta for comparable firms. (1 mark) $2,000 $300 $500 d) Estimate the average unlevered beta of comparable firms. (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts