Question: You are trying to value a quantum-computing startup company. Unfortunately, there are no publicly traded peers available. The best comparable is a division of

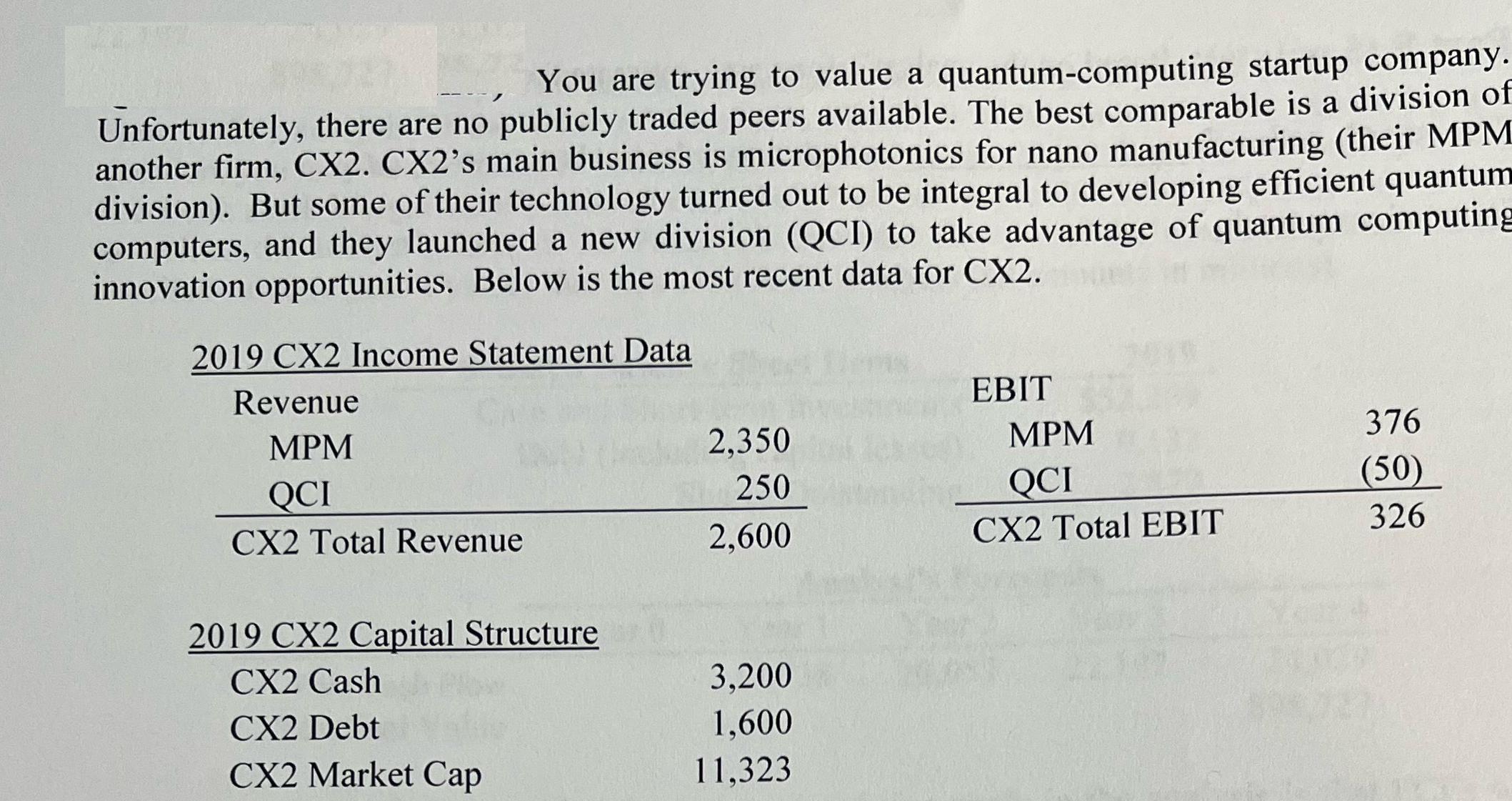

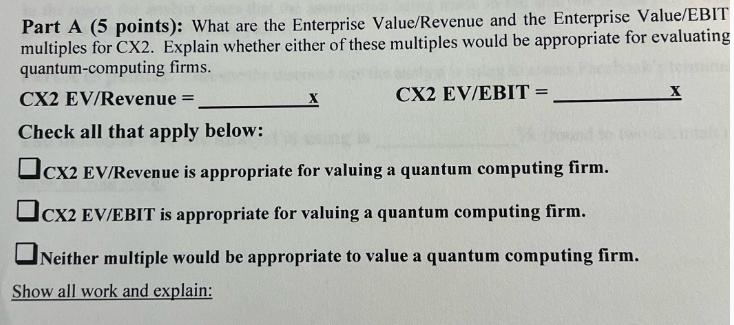

You are trying to value a quantum-computing startup company. Unfortunately, there are no publicly traded peers available. The best comparable is a division of another firm, CX2. CX2's main business is microphotonics for nano manufacturing (their MPM division). But some of their technology turned out to be integral to developing efficient quantum computers, and they launched a new division (QCI) to take advantage of quantum computing innovation opportunities. Below is the most recent data for CX2. 2019 CX2 Income Statement Data Revenue MPM QCI CX2 Total Revenue 2019 CX2 Capital Structure CX2 Cash CX2 Debt CX2 Market Cap 2,350 250 2,600 3,200 1,600 11,323 EBIT MPM QCI CX2 Total EBIT 376 (50) 326 Part A (5 points): What are the Enterprise Value/Revenue and the Enterprise Value/EBIT multiples for CX2. Explain whether either of these multiples would be appropriate for evaluating quantum-computing firms. CX2 EV/Revenue = Check all that apply below: Cx2 EV/Revenue is appropriate for valuing a quantum computing firm. CX2 EV/EBIT is appropriate for valuing a quantum computing firm. Neither multiple would be appropriate to value a quantum computing firm. Show all work and explain: CX2 EV/EBIT = X X You are trying to value a quantum-computing startup company. Unfortunately, there are no publicly traded peers available. The best comparable is a division of another firm, CX2. CX2's main business is microphotonics for nano manufacturing (their MPM division). But some of their technology turned out to be integral to developing efficient quantum computers, and they launched a new division (QCI) to take advantage of quantum computing innovation opportunities. Below is the most recent data for CX2. 2019 CX2 Income Statement Data Revenue MPM QCI CX2 Total Revenue 2019 CX2 Capital Structure CX2 Cash CX2 Debt CX2 Market Cap 2,350 250 2,600 3,200 1,600 11,323 EBIT MPM QCI CX2 Total EBIT 376 (50) 326 Part A (5 points): What are the Enterprise Value/Revenue and the Enterprise Value/EBIT multiples for CX2. Explain whether either of these multiples would be appropriate for evaluating quantum-computing firms. CX2 EV/Revenue = Check all that apply below: Cx2 EV/Revenue is appropriate for valuing a quantum computing firm. CX2 EV/EBIT is appropriate for valuing a quantum computing firm. Neither multiple would be appropriate to value a quantum computing firm. Show all work and explain: CX2 EV/EBIT = X X

Step by Step Solution

There are 3 Steps involved in it

To calculate the Enterprise ValueRevenue EVRevenue and Enterprise ValueEarnings Before Interest and ... View full answer

Get step-by-step solutions from verified subject matter experts