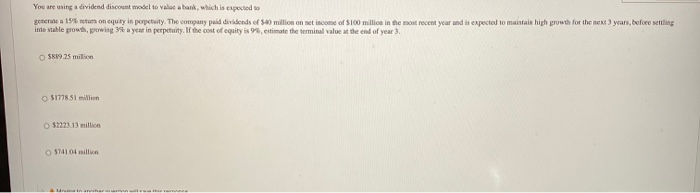

Question: You are using a dividend discount model to vale a bank, which is expected to generate a 15% netum oncquity in perpetuity. The company paid

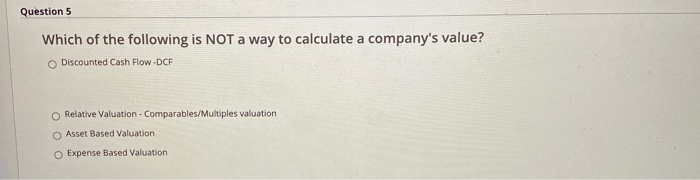

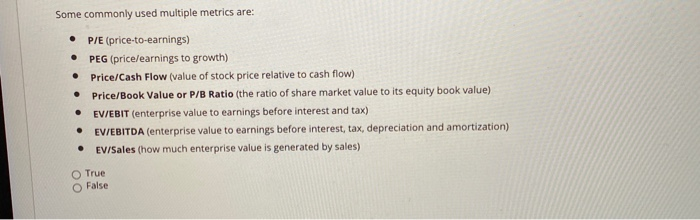

You are using a dividend discount model to vale a bank, which is expected to generate a 15% netum oncquity in perpetuity. The company paid dividends of 500 million on net income of $10 million in the most recent year and is expected to maintain high growth for the next 3 years, before setting inte stable growth, growing 6 yeu in perpetuity. If the cost of equity is estimate the terminal value at the end of year) $819.25 milion S1778 51 million $7223 13 million 574101 million Question 5 Which of the following is NOT a way to calculate a company's value? Discounted Cash Flow-DCF Relative Valuation - Comparables/Multiples valuation Asset Based Valuation Expense Based Valuation . Some commonly used multiple metrics are: P/E (price-to-earnings) PEG (price/earnings to growth) Price/Cash Flow (value of stock price relative to cash flow) Price/Book Value or P/B Ratio (the ratio of share market value to its equity book value) EV/EBIT (enterprise value to earnings before interest and tax) EV/EBITDA (enterprise value to earnings before interest, tax, depreciation and amortization) EV/Sales (how much enterprise value is generated by sales) . . . True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts