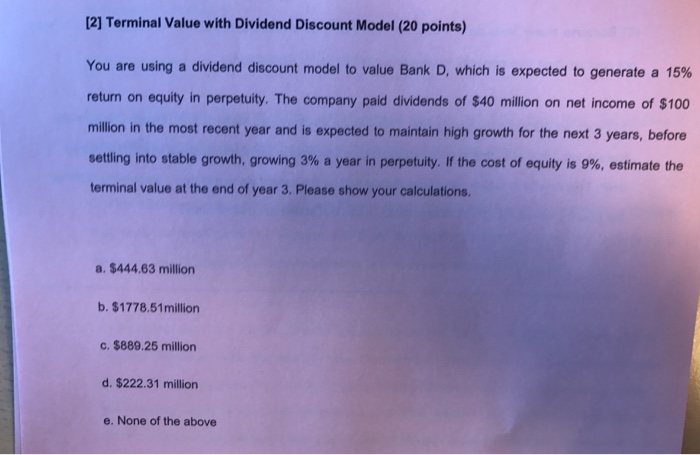

Question: You are using a dividend discount model to value Bank D, which is expected to generate a 15% return on equity in perpetuity. The company

You are using a dividend discount model to value Bank D, which is expected to generate a 15% return on equity in perpetuity. The company paid dividends of exist40 million on net income of exist100 million in the most recent year and is expected to maintain high growth for the next 3 years, before settling Into stable growth, growing 3% a year in perpetuity If the cost of equity is 9%, estimate the terminal value at the end of year 3. Please show your calculations. a. exist444 63 million b. exist1778.51 million c. exist880.25 million d. exist222.31 million e. None of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock